Crypto Markets Digest Last Week’s Massive Gain

|

Seven days ago, on Friday, Oct. 25, Bitcoin surged nearly 40% in less than 24 hours, triggered in part by pro-blockchain announcements in Beijing.

We haven’t seen burst of acceleration of that magnitude since the early days of 2010 and 2011, when the price of Bitcoin was still in single digits.

So this week, it’s no surprise that the market has been focusing on digesting the news from China and settling down into a new, higher trading range.

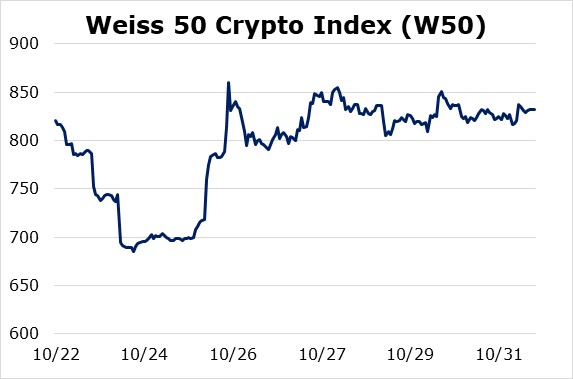

Starting with our most comprehensive view of the industry, the Weiss 50 Crypto Index barely posted any change, up 1.43% on the week (based on last night’s closing prices).

|

Even when we strip out Bitcoin (often an outlier in crypto markets), the picture is similar: The Weiss 50 ex-Bitcoin Index was also up a modest 2%.

This tells us that altcoins again took the lead this week, outperforming Bitcoin, but only by a small margin.

|

Is the Bull Market Back?

A comparison of small- vs. large-cap cryptos provides some clues:

The Weiss Small-Cap Crypto Index had the best week of the entire group, up 7.46%.

|

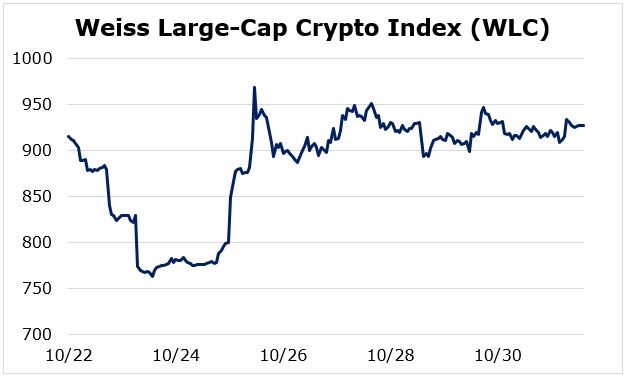

In contrast, the Weiss Large-Cap Crypto Index barely moved up at all — just 1.28% for the week, thanks largely to the sideways action in Bitcoin.

|

This is the kind of pattern that we typically associate with bull markets — small caps posting the strongest gains, while large caps post the smallest.

It’s a significant departure from most of 2019, when investors concentrated on Bitcoin and higher-market-cap altcoins almost exclusively, while smaller projects barely got any attention.

And if it persists, it could add weight to the argument that cryptocurrencies are in a long-term bull market.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.