|

I’ve done pretty well in life. But I feel like a skid row bum next to my two richest friends, both of whom are rapidly approaching billionaire status.

The one thing these two almost-billionaires have in common, besides me, is that they made their fortunes — big, BIG fortunes — in the venture capital business.

If I had only invested in their VC funds, I’d be a very rich man today. Unfortunately, their minimum investments are many times larger than my entire net worth.

Still, I’ve done very well by investing in the same big-picture themes that they have.

So, where are the super-rich venture capitalists investing today? Like always, VCs are laser-focused on technology startups. But they’re especially interested in blockchain-related enterprises.

Blockchain, as a reminder, is the underlying technology that powers cryptocurrencies, like Bitcoin.

|

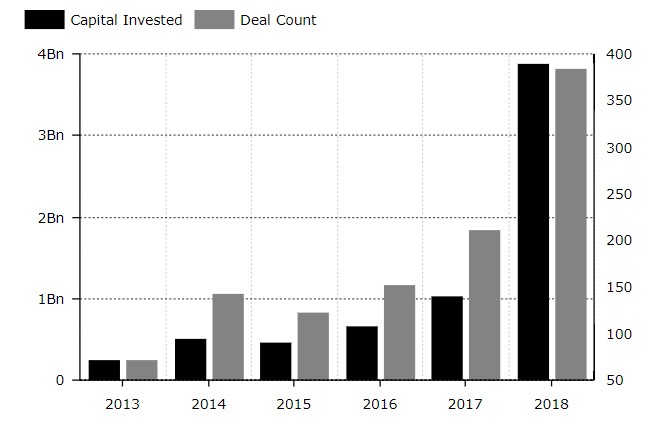

In just the first three months of 2019, venture capitalists have invested $850 million in blockchain-focused startups, according to VC observer PitchBook. At this pace, it will break last year’s record of $2.4 billion.

If you include cryptocurrency startups, the number balloons to $3.9 billion. Wow!

One extremely important distinction about venture capitalists, like my two friends, is that they invest a monster amount of their own capital alongside the outside investors.

There are two investors in VC funds:

- General Partners: the people in charge of making the investment decisions, and …

- Limited Partners: the outside investors — pension funds, endowments, hedge funds, family offices, etc. — who provide the capital necessary to complete those investments.

My two friends, as general partners, routinely invest tens of millions of their own money, along with the limited partners. They have a lot of personal skin in the game.

So, if venture capitalists are throwing billions, a lot of which is their own money, into blockchain-focused businesses ... so should you!

Here’s how can you invest like a VC in the booming blockchain industry, without spending big bucks:

If you’re an ETF investor, there are several blockchain-focused ETFs to consider:

- Amplify Transformational Data Sharing ETF (BLOK)

- Reality Shares Nasdaq NexGen Economy ETF (BLCN)

- First Trust Indxx Innovative Transaction & Process ETF (LEGR)

- Innovation Shares NextGen Protocol ETF (KOIN)

Don’t be concerned that none of the above ETFs contain the word “blockchain.” The Securities and Exchange Commission has prohibited the ETF industry from using blockchain in their fund names.

But even if you can't call it a rose, the potential profitability of these kinds of investments can smell just as sweet.

Those blockchain-focused ETFs should do well. However, the big bucks — the REALLY big bucks — will be made on the handful of stocks that are cashing in on the blockchain gold rush.

Such as?

Some of the big tech names you already know — Alphabet (GOOGL), Microsoft (MSFT), Facebook (FB) and Amazon (AMZN), for starters — but also dozens of rapidly growing, aggressive upstarts that few have heard about ... which are exactly the type of companies that my Weiss Crypto Investor uncovers.

I’m putting the finishing touches on my next blockchain-based stock pick for my Weiss Crypto Investor subscribers. I plan to release it in the next few days. To be among the first to get my best blockchain picks — and to be able to invest in the same opportunities that venture capitalists are— click here.

Invest like a VC. Invest in blockchain.

Best wishes,

Tony Sagami