World Bank Issues First-ever Blockchain Bonds: Time to Pop the Blockchain Champagne!

|

Blockchain is steadily becoming a big part of the corporate IT landscape. And a handful of companies that provide this secure technology are already enjoying some pretty nice profits because of it.

I've been telling you to invest in this trend early. But I've also said not to start popping the blockchain champagne until big government starts to adopt it, too.

Well, that day has finally arrived.

The World Bank is one of the most powerful financial institutions in the world. It was created in 1944 to rebuild post-World War II Europe. Now its mission is to fight poverty around the world.

It does this by providing grants, loans, training and assistance to the governments of low- and middle-income countries for the purpose of financing key capital projects. Last year, it approved $10.7 billion for 56 such projects.

One of those projects … you guessed it … is blockchain.

The World Bank established a blockchain innovation lab two years ago, to fund poverty-reduction projects worldwide.

Per an August press release:

"The World Bank’s blockchain innovation lab was established in 2017 as an innovation hub for poverty reduction projects across the world and includes developing opportunities to use blockchain and other disruptive technologies in areas such as land administration, supply chain management, health, education, cross-border payments, and carbon market trading."

In short, the World Bank is a huge player in the global financial picture. And it believes so much in the technology behind cryptocurrencies that it is now issuing blockchain-powered bonds.

These debt instruments — called "bond-i" — are the first bonds to be issued and recorded on a blockchain platform.

|

The World Bank quietly sold a small issue of blockchain-secured bonds in 2018. I say quietly because it was just a few million dollars in size. At the time, it didn't want to generate any attention in case the blockchain bonds blew up in its face.

However, that small issue of blockchain bonds was so popular, and such a logistical success, the World Bank is now jumping headfirst into these blockchain-powered bonds.

The World Bank has just completed the sale of another $108 million of blockchain-based bonds, with plans to rapidly ramp up from there.

To do that, it has enlisted the help of the Commonwealth Bank of Australia, RBC Capital Markets and TD Securities to "create, allocate, transfer and manage through its life-cycle" these blockchain-operated debt instruments.

Sophie Gilder, head of blockchain and artificial intelligence at the Commonwealth Bank of Australia, said:

"CBA now has tangible evidence ... that blockchain technology can deliver a new level of efficiency, transparency and risk-management capability vs. the existing market infrastructure."

These new blockchain bonds make it possible for investors like you and me to trade the bonds on a secondary market.

All ownership and transaction records will be recorded on the blockchain and, according to the World Bank, this is "the first bond whose issuance and trading are recorded using distributed ledger technologies."

Look, the World Bank wouldn't issue a second issue of blockchain-based bonds unless it was very confident in the technology. So, I expect more and more governments and corporations to follow suit.

Imagine the TRILLIONS of dollars' worth of bonds that could move to blockchain. Imagine the BILLIONS of dollars that forward-looking banks/brokers are going to make by handling the issuance of blockchain bonds.

In short, blockchain is going to revolutionize the way that bonds are issued and traded. And with any revolution, there are going to be winners and as well as losers.

I'm pretty sure I know exactly who the big winner(s) will be, and those stocks are part of the Weiss Crypto Investor portfolio. We are looking at big open gains like 44.6%, 38.9% and 29.3%, and those are just the early returns. Click here to join me now, and you'll be on board to see these picks and others potentially skyrocket as blockchain really takes off.

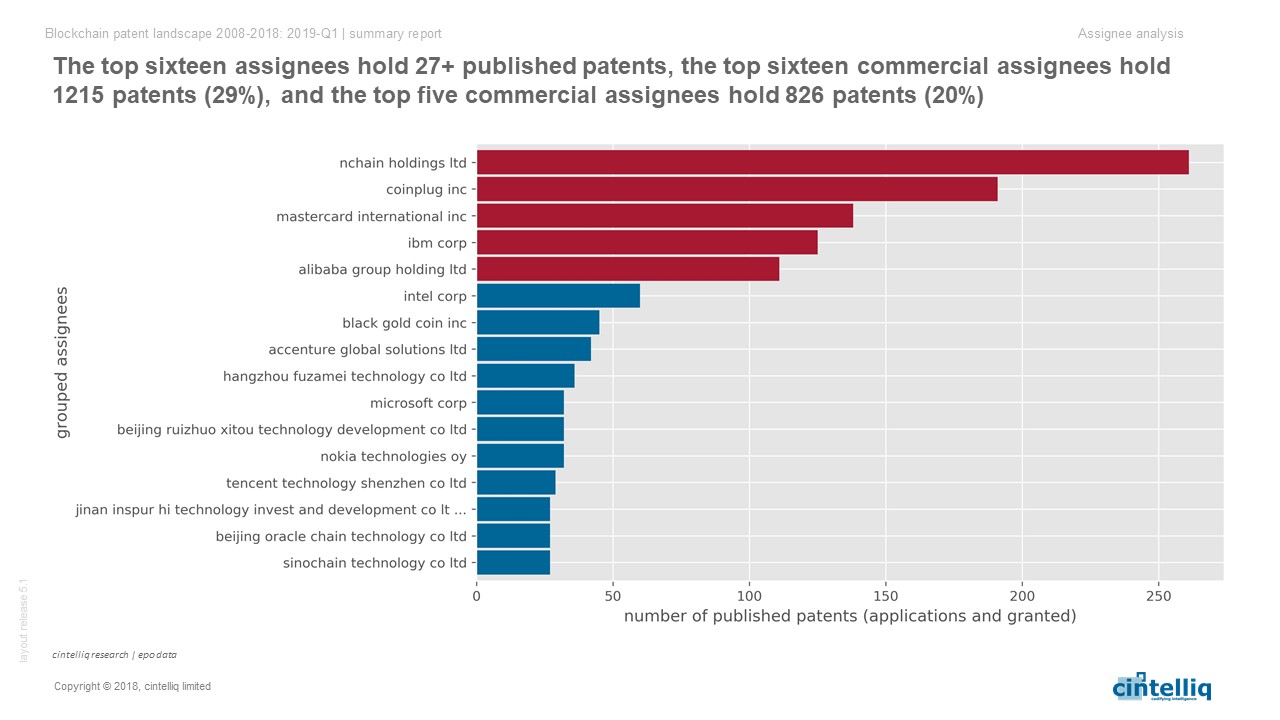

Who are these blockchain kings? You can start by looking at what companies own the most blockchain patents.

|

When it comes to technology, patents mean control. And control means riches.

The best news of all is that we are in the first inning of the blockchain revolution. There is still huge, huge money to be made by investing in the right blockchain stocks.

Jump on board ... now! There are fortunes about to be made. My subscribers are at the forefront of this revolution. Join them here.

Best wishes,

Tony Sagami