3 Big Reasons to Be Bullish on Bitcoin

Over the past week, we’ve seen quite a bit of sideways consolidation for the King of Crypto. But this shift isn’t the whole story.

Here are three reasons you should still be bullish on Bitcoin (BTC, Tech/Adoption Grade “A”) ...

Reason No. 1: QE Infinity

Trying to shore up an economy in the throes of pandemic panic, the Federal Reserve has turned on the monetary fire hoses.

To this end, it recently printed $2.9 trillion in new paper money in the space of just 13 weeks. That works out to about $22 million a minute. Round-the-clock. Evenings, weekends and holidays included.

By any measure, this is corruption of money on an industrial scale.

Historically, investors pour into gold as a safe haven when they lose confidence in paper money. This time, they're going to pour into Bitcoin as well. And indeed, both are already on the rise.

However, Bitcoin's been going up faster, outperforming gold since the pandemic panic hit. And this is just the beginning ...

Reason No. 2: Institutional

Money Pouring into Bitcoin

A few weeks ago, hedge fund titan Paul Tudor Jones ploughed $210 million of his own money into Bitcoin.

Grayscale Bitcoin Trust (OTC: GBTC) is scooping up Bitcoin faster than new coins are being minted. Now comes major venture capitalist Andreessen Horowitz who recently raised half a billion dollars to invest in crypto start-ups.

Not only is this some of the smartest money on Wall Street. But the sheer weight of institutional-sized money flows into a small market like Bitcoin can have truly explosive effects.

For example, Bitcoin’s market cap ($170 billion) is only 1/218th the size if the U.S. stock market (approximately $37 trillion).

So, just 1% or 2% of that much wealth pouring into crypto … would be more than sufficient to send Bitcoin to undreamed of heights.

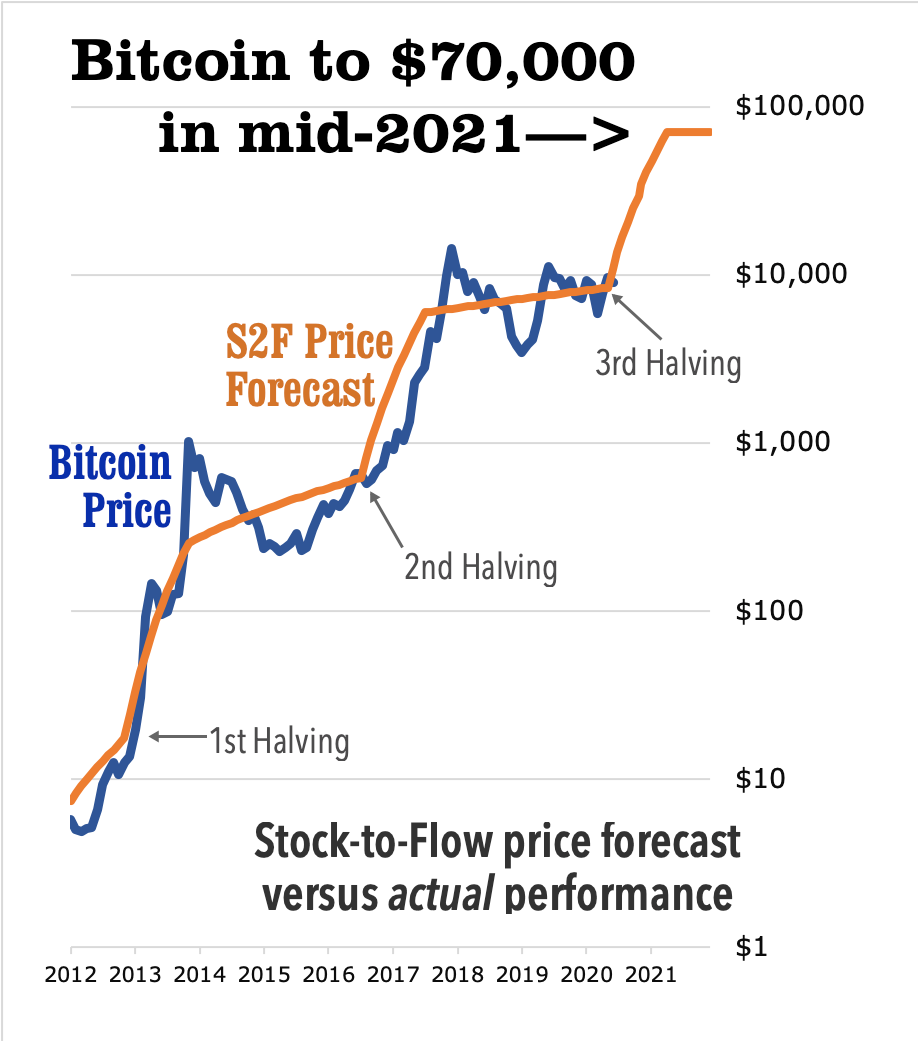

Reason No. 3: Popular Forecast Says

Bitcoin Will Hit $70,000 Next Year

Stock-to-flow analysis (S2F) focuses on the broad shape of future prices.

Although based on a different methodology than the one used by the Weiss Cryptocurrency cycles model, it is widely respected in the crypto world.

And it now points to a ferocious rally over the next 12 months or so.

S2F is based on the common-sense notion that the scarcer a commodity is, the more valuable it becomes.

And it measures scarcity by comparing annual production to the amount available for buying and selling (circulating supply).

Gold has an S2F of 62 — the number of years of current production required to match global above-ground holdings.

By contrast, it takes only 22 years of current silver production to equal above-ground supplies. The relative lesser scarcity of silver is a key factor that makes silver less valuable than gold.

After the May 2020 halving, 6.25 new Bitcoin are now being created every 10 minutes. That means it would take an estimated 56 years for new mintage to match Bitcoin's circulating supply.

Notice how close that is to the S2F number for gold, which makes sense because Bitcoin is fast becoming a major rival to gold as a safe-haven investment.

(Halving refers to the 50% cut in the rate at which new Bitcoins are created. This occurs roughly everyfour years. And historically, it has been a harbinger of explosive price gains over the next 12 to 18 months.)

As you can see from the chart above, previous S2F predictions line up quite well with Bitcoin’s actual price performance. Now, based on the history of the halving, current S2F analysis says Bitcoin should reach $70,000 by — sometime around mid-2021.

Even if it turns out to be only half right, you could still triple your money.

So, what should a Bitcoin bull do in this environment?

Long-term investors should look for weakness in this crypto asset for entry points and hold on tight. The long-term outlook could scarcely look more exciting.

Best wishes,

Juan and Bruce