3 Charts That Tell You All You Need to Know About Bitcoin in 2021

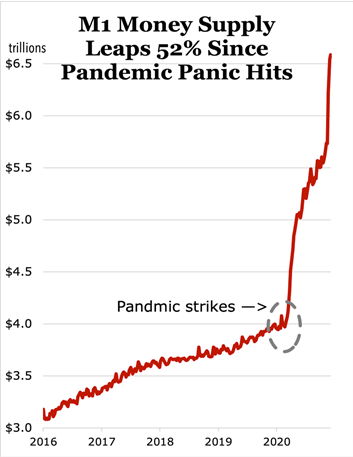

Almost lost in all the hoopla surrounding Bitcoin (BTC, Tech/Adoption Grade “A-”) punching through $24,000 has been the massive expansion in the U.S. money supply.

M1, the narrowest, most liquid measure of money, has shot up more than 50% just since March — which is when pandemic panic first hit the economy and the markets like a ton of bricks.

Basically, the Federal Reserve is pumping up the American money supply at the fastest pace ever seen.

|

| Chart 1: M1 money supply growth |

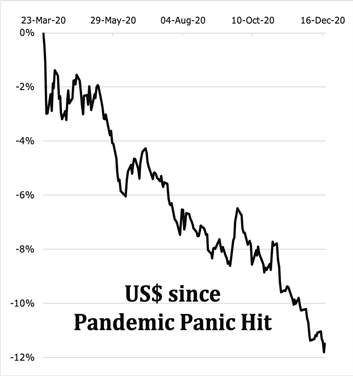

And as the number of dollars grows far faster than the supply of goods they can buy, each single bill is worth less and less.

And, in fact, this loss of value is precisely what’s showing up on global foreign exchange markets.

The trade-weighted U.S. dollar index, compiled by the St. Louis Federal Reserve (Chart 2), has fallen almost 12% since the pandemic hit.

|

| Chart 2: U.S. dollar index |

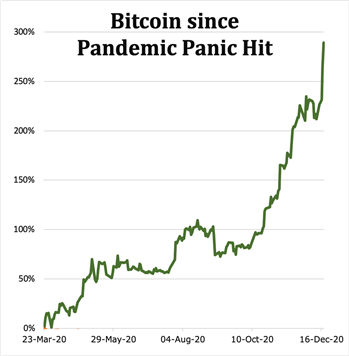

What do people do when they start losing confidence in paper currency?

They flock to save haven investments beyond the long reach of governments to corrupt.

Historically, this has been gold (and silver). But now, a new kid on the block is stealing a lot of gold’s thunder: Bitcoin.

And sure enough, the same post-COVID pumping up of the money supply that pulled the dollar down also ignited a blistering 289% rally in Bitcoin (Chart 3). It’s all quite logical.

|

| Chart 3: Bitcoin daily prices |

Two Things to Keep in Mind Going Forward

First, note how strongly the leverage favors Bitcoin. 52% money growth — which led to a 12% decline in the dollar — sent Bitcoin blasting nearly four-fold.

So, if you want to make money in 2021, forget about shorting the dollar. Or even buying gold. You should consider putting some of your money in the King of Crypto and enjoying the fireworks.

Second, ever since the heyday of monetarism in the 1980s, economists have been debating how long it takes for changes in the money supply to impact the real world of consumer and asset prices.

The only consensus ever to emerge was that it doesn’t happen right away. It takes months, maybe even several quarters to be fully felt.

So, even if the Fed took its foot off the gas today — which is almost beyond the realm of possibility — there’s likely enough fuel already in the system to keep Bitcoin going up through most of 2021.

In short: 2021 is going to be a great year for crypto. Happy Holidays!

Best,

Juan and Bruce