5 Reasons Bitcoin’s adoption is stronger than ever

When we first gave Bitcoin a “C+” rating, Bitcoin lovers fumed with anger.

Even when we explained precisely why — high investment risk and lagging technology — they still weren’t very happy.

What most people seem to have missed is this: From the outset, we have always given Bitcoin a top score for adoption, one of the four key components of our ratings model.

And over the past year, even as the price of Bitcoin sank, its adoption metrics have improved for five fundamental reasons:

Reason #1

Bitcoin is now even more secure.

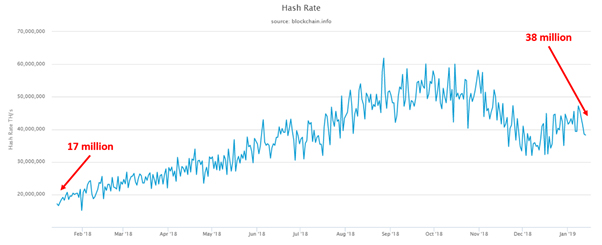

Compared to one year ago, the computing power deployed on the Bitcoin network by users all over the world has more than doubled.

How do we know? Because the best metric to track that computing power — the hash rate — has surged from 17 million terahashes per second in January 2018 to 38 million today. (See chart 1.)

|

Source: www.blockchain.com

And this isn’t just idle tech talk. The hash rate is the best possible measure of network security. The higher it is, the harder it becomes for anyone to mount a 51% attack. It’s estimated that, to carry out such a massive operation, it would cost hackers about $280,000 per hour.

That’s because they’d have to pay that much to rent readily available computing power from large mining pools. Moreover, there’s no mining pool in the world with the capacity to rent out anywhere near that much. And if the attacker wanted to buy their own hardware, it would still be crazy-expensive — maybe $1 billion to $2 billion of capital expenditures.

Reason #2

The number of daily active addresses is stable.

|

Source: www.blockchain.com (top) https://bitinfocharts.com (bottom)

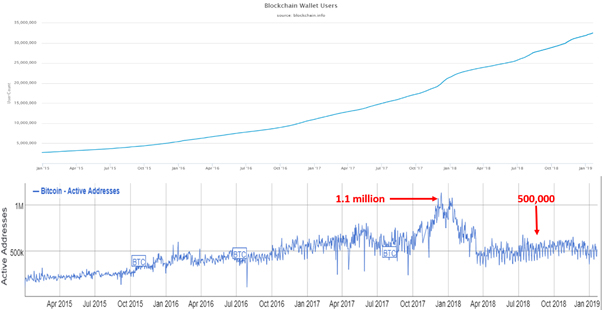

The number of blockchain.com wallet users has increased steadily throughout the past four years (top chart). Trouble is, old addresses are almost never deleted, which helps explain why the number just keeps going up through thick and thin.

So, for a reality check, we also look at the number of daily active users on the Bitcoin network. We find that, since April of last year, about a half-million or so addresses have been active every day, a good proxy for the trends in usage.

In a big bear market, this kind of stability is an encouraging sign.

Reason #3

Transaction volume has doubled.

|

Source: www.blockchain.com

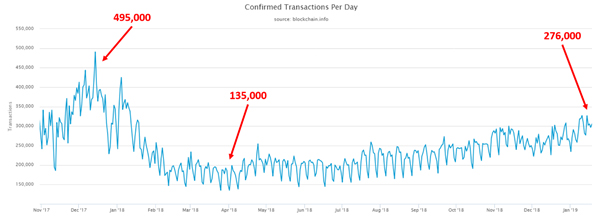

From their 2017 peak, Bitcoin daily transactions dropped to 135,000. Given the price crash, that should come as no surprise. Speculators and weak hands did what they always do: They bailed out.

But since then, despite the continuing tough market, transactions have improved steadily to 276,000 per day. That’s darn healthy. It tells us that, once the fever and frenzy were squeezed out of the market, stronger, steadier hands have prevailed and become more active.

Reason #4

The average transaction fee is down to about 25 cents.

|

Source: www.blockchain.com

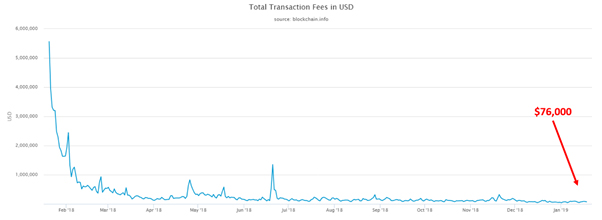

At the peak in 2017, Bitcoin transaction fees were often higher than the transaction was worth to begin with. But now, they’ve not only fallen from those ridiculous peaks, but they’ve also leveled off in a very affordable, comfortable range.

Currently, the total fees paid to miners on the network is around $76,000 per day. Since that’s for approximately 300,000 different transactions, the average fee is only about 25 cents per transaction.

That’s cheap, and another positive factor for adoption.

Reason #5

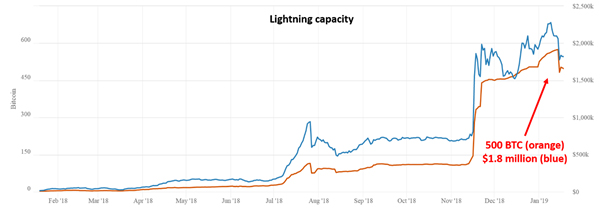

Bitcoin’s Lightning Network has grown nicely.

|

Source: https://bitcoinvisuals.com

The Lightning Network is effectively a Bitcoin upgrade that makes the network faster and more scalable.

And throughout 2018, even as the price of Bitcoin market continued to sag, the capacity of the Lightning Network continued to grow.

At the beginning of the year, the project was just getting off the ground, and there were virtually zero nodes. Now there are roughly 2,600.

The number of Bitcoins that can be transacted through the Lightning Network grew in tandem. The year started with almost none. Now there are about 500 (orange line in chart) worth about $1.8 million (blue line in chart).

More importantly, there’s a lot more room to grow, with essentially no limit to the Lighting Network’s capacity.

Does all this mean Bitcoin merits an upgrade? Maybe. But while adoption has been improving, our risk/reward metrics have been sliding. So, for now at least, that has dampened Bitcoin’s overall grade.

The good news is that, when markets improve, Bitcoin’s “C+” rating could be history.

Best,

Bruce