A Big Bitcoin Bounce, and What Crypto Enthusiasts in the Big Apple are Even More Excited About

|

The older I get, the more I realize how much more I have yet to learn. Which is why I fly across oceans in cramped coach seats (I'm too cheap to pay for business class) to attend conferences.

My latest learning adventure took me to New York last week. There, I attended the Consensus 2019 conference, the premier cryptocurrencies and blockchain event in the world.

Everybody and anybody — from chief technology officers of the world's largest companies to cyber punks with purple hair — who is serious about understanding one of the most important and rapidly changing technological revolutions of our lifetime was there.

This conference in the Big Apple attracted a cornucopia of speakers and attendees from all over the world: China, Japan, Korea, Australia, India, Germany, England, France, Spain, Russia, Estonia, Brazil, Chile, Argentina, South Africa and more.

Everybody was pumped up, and for good reason. Cryptocurrency prices have been on fire this year — going up as much as 100% in the first five months of 2019. So, the passionate energy of crypto enthusiasts, who felt validated by Bitcoin's recent jump above $8,000, was understandably palpable.

|

|

Image credit: WeissCrypto.com |

In fact, cryptocurrency prices have often moved higher in the weeks leading up to the Consensus conference. For example, Consensus 2017 was held May 13-15, and Bitcoin surged by 60% during the event.

Related post: Bitcoin: Best-ever initial recovery from bear market

That's pretty unprecedented. So was this …

I've been to several cryptocurrency/blockchain conferences. The most noticeable difference this time was the presence of mainstream giants like Microsoft, IBM, Amazon Web Services, eBay, Citigroup, Fidelity, Accenture, Deloitte Consulting, and India tech leader Tata Consultancy.

Of course, there were lots of new startups that I've never heard of. But the presence of these "big boys" shows how mainstream cryptocurrencies and blockchain have become.

Related post: Why I was just called a 'Stupid SOB' at a landmark crypto conference in Asia

Moreover, the emphasis, enthusiasm and tidal wave of money is focused on the adoption of blockchain, and NOT on the use of cryptocurrencies.

Yes, the emphasis of the conference was on the technology behind every cryptocurrency, instead of on the cryptocurrencies themselves.

[See our ratings on 120+ cryptocurrencies at https://weisscrypto.com/en/coins.]

Blockchain technology is currently being adopted at all levels of the business world and throughout all industries: banking, insurance, finance, real estate, utilities, healthcare, education, agriculture and government. And business leaders at companies big and small are spending lots of money.

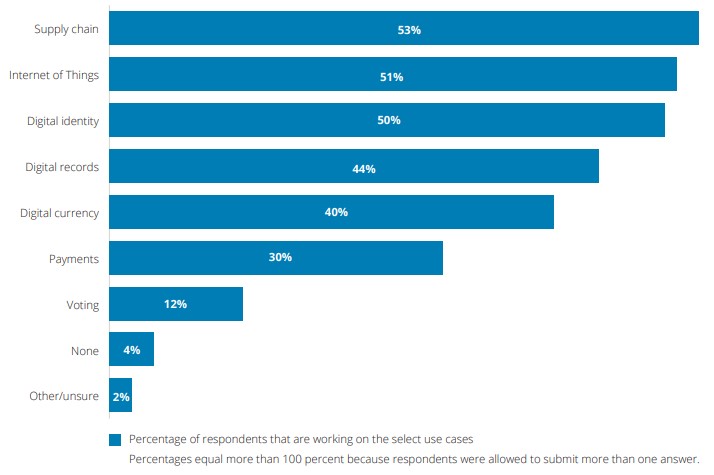

A Deloitte survey showed that 49% of its clients plan to invest $1 million to $10 million in blockchain initiatives in 2019. Here are the biggest the use cases that these companies have identified:

|

From companies' supply chains and digital records to customers' digital identities and payments, one thing is clear …

Blockchain is big … and getting bigger by the day.

That doesn't mean you should avoid cryptocurrencies themselves. My colleague Juan Villaverde makes a compelling case for a select handful of those, based on his research and the powerful Weiss Crypto Ratings. Be sure to read his articles on Wednesdays for which ones to buy, avoid or watch. (You can find Juan's and my most recent articles here.)

What I am saying is that you should not overlook the stocks of companies that are ushering in the blockchain revolution.

By the way, I encourage you to spend some time at the Weiss Crypto Ratings site to see how your favorite coins are graded. You'll find a ton of free, valuable information and tools like our free watchlist. Just tell us which coins you'd like to track for you, and we'll send you an email alert whenever the ratings change. It's all online, waiting for you, at WeissCrypto.com.

Best wishes,

Tony Sagami