An ETF Would Send the King of Crypto Skyrocketing

|

I can tell you EXACTLY when Bitcoin is going to skyrocket.

When the Securities & Exchange Commissions approves the first Bitcoin ETF.

It's no exaggeration to say that the arrival of a Bitcoin ETF is going to unleash a tidal wave of money into Bitcoin. The reason is simple: Secure custodianship.

If you're a money manager, the last thing you want to happen is for some highly-skilled bad guy to hack your crypto wallet and steal a couple million dollars of your clients' money. That's the type of disaster that would put an investment advisor out of business.

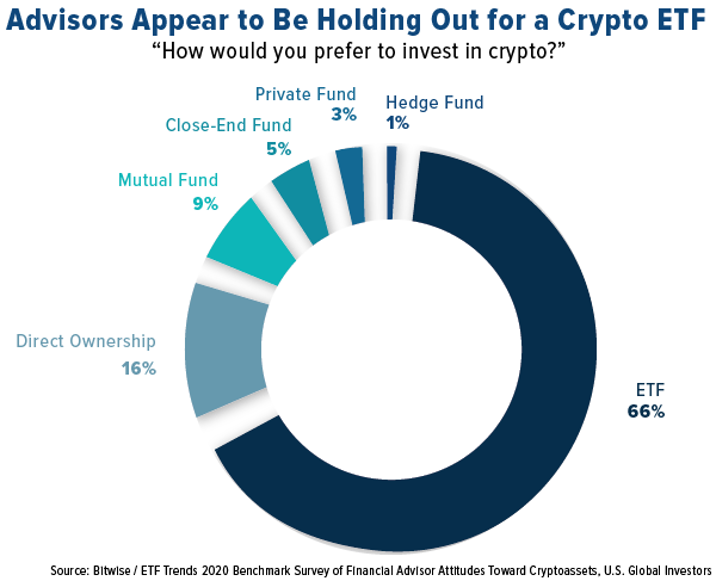

That’s why a new survey from ETF Trends found that almost two-thirds of investment advisors are waiting for an exchange traded fund or ETF vehicles before adding Bitcoin to their portfolio.

|

The reason that professional money managers haven't invested in Bitcoin (and other cryptocurrencies) is that they don't trust crypto wallets.

About 65% of those surveyed said that their preferred vehicle are ETFs. A distant second at 16% is direct ownership (crypto wallets) while only 9% prefer a mutual fund.

There are trillions of dollars under professional money management. The decision to increase cryptocurrency exposure from 0% to even just 1% would be enormous.

The market cap of Bitcoin is around $130 billion, so the approval of a Bitcoin ETF could double, triple or even quadruple the market cap of Bitcoin in a very short period of time. Perhaps in as little as a few weeks.

$100,000 per Bitcoin is not out of the question. In fact, that may be too conservative.

But all that is just a dream at the moment. That’s because the real trick is being able to say exactly when the SEC will approve a Bitcoin ETF.

The Securities & Exchange Commission has been considering crypto ETF applications for almost two years. But it still hasn’t approved a single one.

The issue is that some people at SEC are worried that Bitcoin could go to zero. However, that's not the SEC's job. It is not responsible for determining what investments are good or bad, but instead making sure the information provided to investors is accurate and that the investing public is fully informed.

That approval could happen next month or next year. But you better get on the crypto train before it pulls out of the station. Once the SEC gives a green light, anybody sitting on the sidelines is going to kick themselves in the butt.

There are many cryptocurrencies that you could buy, but my money is on the King of Crypto, Bitcoin. And I am very confident that you'll make a mountain of money.

As for timing, pay close to attention to the signals that my colleague, Juan Villaverde, sends out. He knows more about cryptocurrency trading cycles than anybody on the planet.

Best wishes,

Tony Sagami