|

I travel a lot. This means I do a lot of my work in coffee shops. I just can’t stand working out of a hotel room.

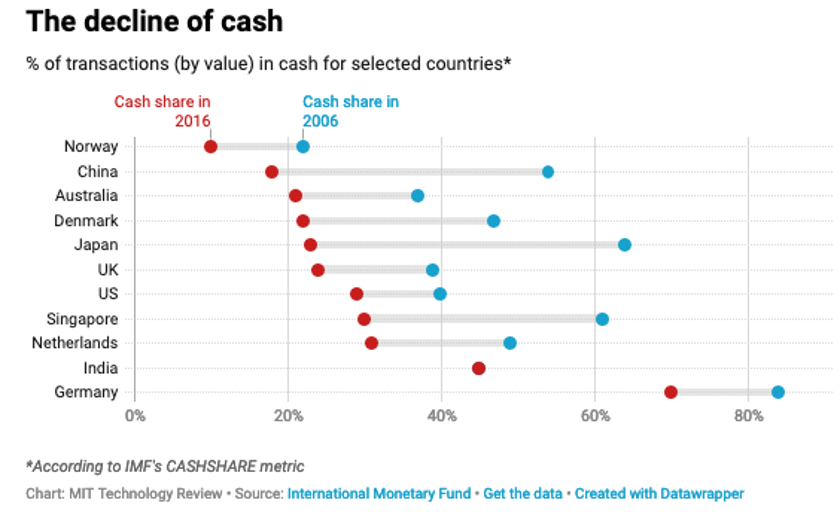

A few months ago, I was working in a coffee shop in Oslo, Norway. When I pulled out a 50 krone note to pay for my latte, the cashier looked at me like I was some sort of nut case.

At the time, I had no idea what my social faux pas was. But soon, I learned that only stubborn old Norwegian Luddites still use cash. Everybody else uses their smartphones to pay for just about everything — including lattes — with a mobile payment app called Vipps.

|

Vipps lets consumers to pay for retail purchases as well as for services like haircuts, gasoline and utility bills. It even allows people to send money to one another.

Norwegian businesses love it because it is easier and safer than dealing with cash.

But while paperless payments are convenient, they’re still not as safe as cryptocurrencies.

In Government We Trust?

Physical cash is headed toward obsolescence in Norway. And it’s already almost extinct in neighboring Sweden, where nearly everyone uses a mobile payment application called Swish.

Sveriges Riksbank, Sweden’s central bank, found in 2018 that only 13% of Swedes used cash for a purchase, down from 40% in 2010, and forecast that Swedish retailers will stop accepting cash by 2023.

The U.S. is way behind Norway and Sweden. But still, most of us — including me — do much of our shopping over the internet and pay with credit or debit cards.

No question, transactions are migrating from the physical world to the digital.

But there is a problem with mobile and online purchases: They rely on middlemen — like banks and fintech companies — to process those transactions.

Call me a dinosaur if you want, but I still see the value of cash. That’s because there is one feature of physical cash that I do value: Privacy.

Physical cash is a bearer instrument. We can use it to transact with a person or business without a third party sticking their nose in the middle and compromising our privacy.

Banks and retailers build advertising profiles or credit ratings from our transaction history. Governments can track our movement and spending behavior. Credit cards can be declined, but cash works every time, instantly.

Without cash, there is no privacy. And that privacy is one of the GREATEST allures of cryptocurrencies.

|

This is why politicians, law enforcement and central bankers don’t like cryptocurrencies. Sveriges Riksbank is so worried that it is toying with the idea to launch a state-backed digital currency. They’re hoping it might play a similar role as physical cash does today.

The intervention of the government automatically disqualifies any state-sponsored digital currency as a cryptocurrency. I wouldn’t touch one of these faux cryptocurrencies with a 10-foot pole.

I have no doubt that physical cash is going to disappear during my lifetime. But that doesn’t mean you should get duped into buying a state-sponsored cryptocurrency.

Stick to corporate-sponsored cryptocurrencies from Facebook (FB) or Apple (AAPL) (for example) for your mobile payment needs. And when it comes to storing your money in a safe place, out of reach from any central authority, you should trust cryptocurrencies like Bitcoin (BTC, Rated “A-”).

Speaking of the King of Crypto, Bitcoin will be going through it’s highly anticipated halving event this May. This event can easily send Bitcoin to $20,000 and likely even higher. And, it’ll bring altcoins along for the ride.

It’s a massive event, and you’ll want to be prepared or risk missing out on unbelievable gains in the crypto sphere.

That’s why you should reserve your spot at Dr. Martin Weiss’s a FREE training event TOMORROW at 2 p.m. Eastern. He’ll cover WHAT to buy ... WHEN to buy ... and WHEN to sell.

To save your seat and learn more about this urgent event, click here.

Best wishes,

Tony Sagami