Bitcoin Consolidates With the Broader Market

|

• Bitcoin (BTC, Tech/Adoption Grade “A-”) is about 1% lower as it looks to hold its ground above $47,500.

• Ethereum (ETH, Tech/Adoption Grade “A-”) is down about 3% and is currently sitting near $3,500.

• Bitcoin’s crypto market dominance is now 41.7% after gaining about 40 basis points.

Bitcoin is still digesting its gains over the past two months, and it continues responding favorably after the leverage-induced sell-off earlier in September. Most of the crypto market is in the red so far today, but we’ll likely see additional consolidation off of the short-term top.

As is usually the case when the market is down, Bitcoin is holding its value better than altcoins. Bitcoin hasn’t revisited its recent low near $43,000 yet ... but it wouldn’t be surprising if the level was retested.

• The King of Crypto looks to be gearing up for a significant breakout when the dust settles, and altcoins would surely follow.

Regardless, Bitcoin’s resurgence after the lengthy consolidation is overwhelmingly positive. BTC just crossed below its 21-day moving average, and it could potentially see a relief bounce.

Here’s Bitcoin’s price in U.S. dollars via Coinbase Global (Nasdaq: COIN):

|

Ethereum has fallen below its 21-day moving average around $3,500, but it should also continue consolidating after the recent top.

Its two biggest resistance hurdles will be at the $3,600 and $3,800 price levels before approaching the psychologically important $4,000 milestone. Ethereum was only able to surpass $4,000 very briefly before stabilizing pre-correction.

Investors are excited about Ethereum’s EIP-1559 upgrade, which sought to make it less inflationary while also lowering gas fees. While the former objective has been successful — with over 312,000 ETH burned to date — gas fees are still exceptionally high because of significant network congestion from non-fungible token (NFT) minting and trading.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

|

Index Roundup

The crypto market lightly rebounded during the seven-day trading week ending Thursday, but we could easily see a period of consolidation. Once again, the gains favored the smallest altcoins.

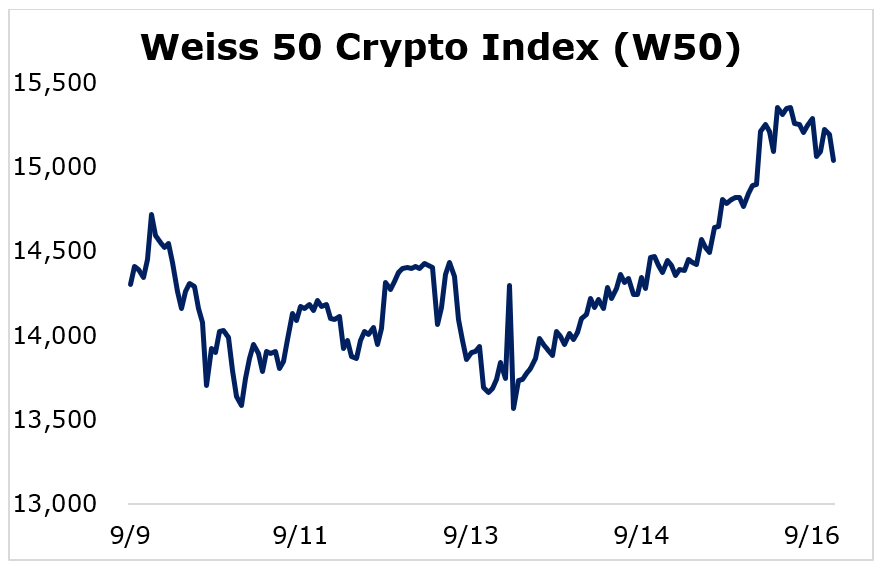

The Weiss 50 Crypto Index (W50) rose 5.12% as the broader market continues to rebound from the violent pullback earlier this month.

|

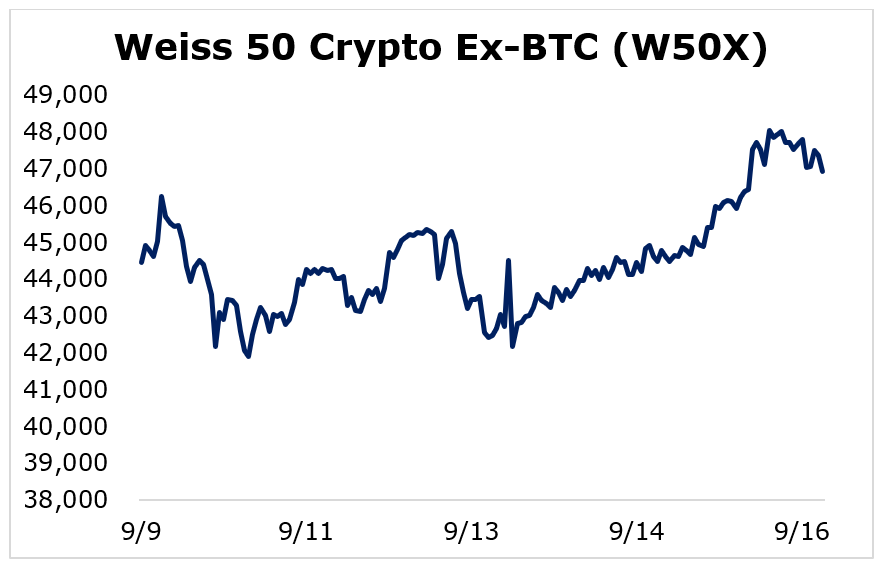

The Weiss 50 Ex-BTC Index (W50X) increased 5.62%, highlighting that Bitcoin performed largely in line with altcoins.

|

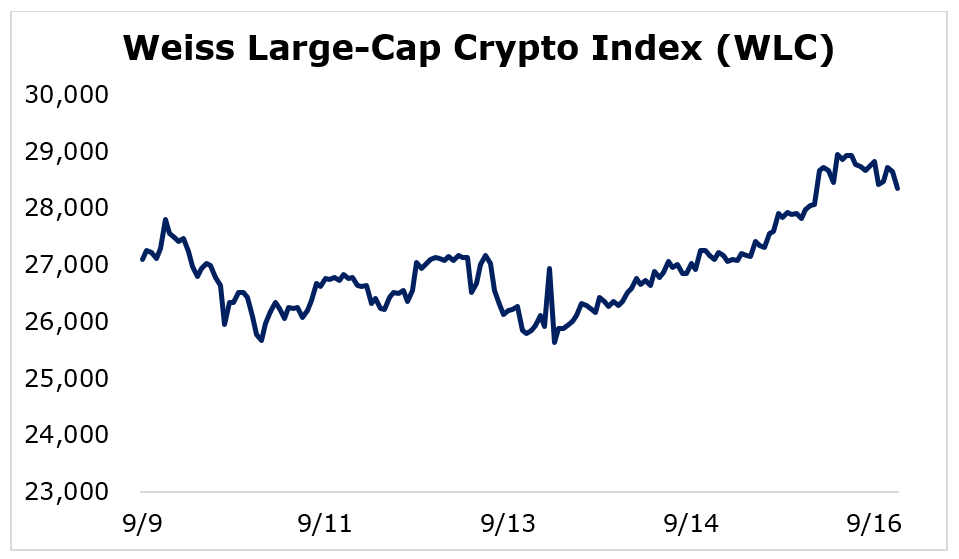

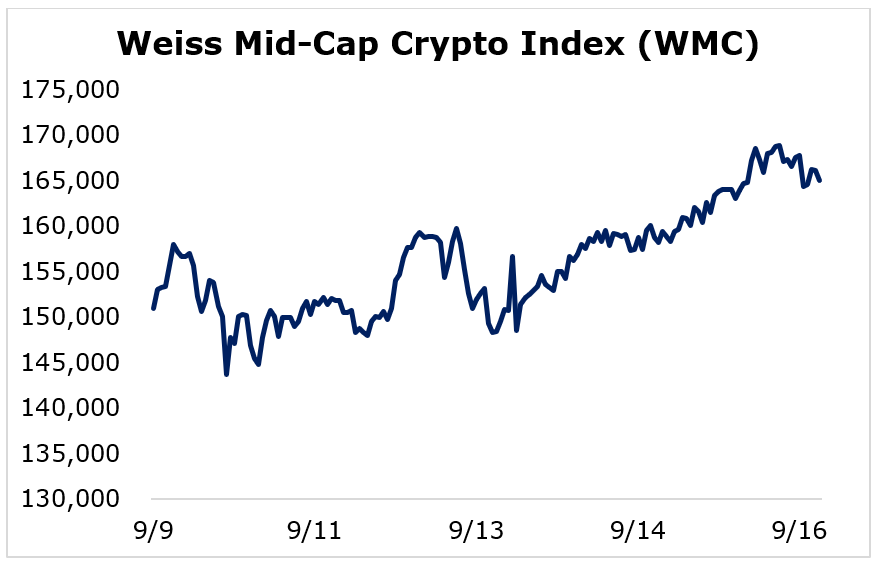

Breaking down performance this week by market capitalization, we see that small-caps continued to outperform their larger and mid-sized counterparts. Trading was relatively muted for the established players, while the smallest cryptocurrencies swung higher.

The large-caps managed to book a slight gain, as the Weiss Large-Cap Crypto Index (WLC) added 4.66%.

|

The mid-caps outpaced the established market leaders, but they still underperformed the smallest cryptocurrencies. The Weiss Mid-Cap Crypto Index (WMC) grew 9.33%.

|

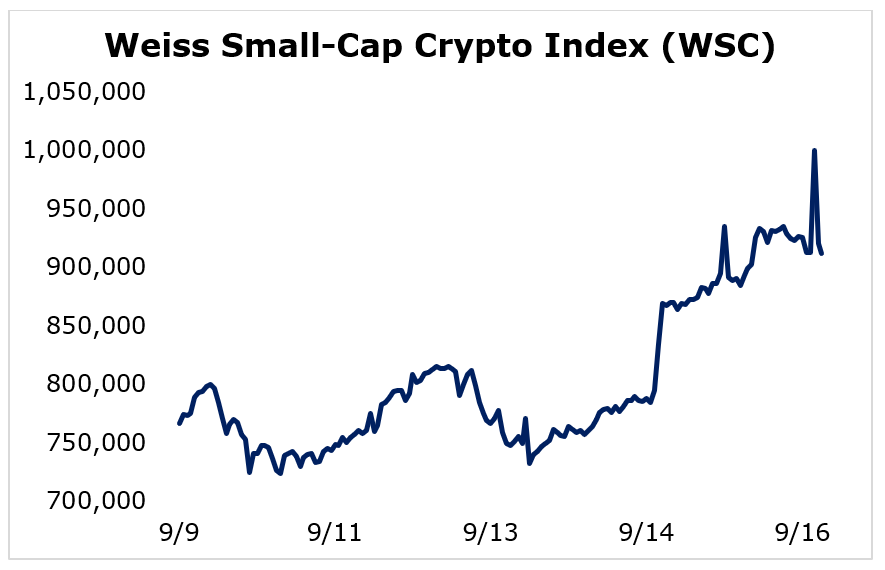

The small-caps were the biggest winners, as the Weiss Small-Cap Crypto Index (WSC) soared 18.99%.

|

The small caps continue to outperform, but they will rely on Bitcoin and the large caps to lead the market higher moving forward. Without Bitcoin’s positive price action and improving market sentiment, smaller altcoins would lack the momentum needed to push forward.

Notable News, Notes and Tweets

• Pomp highlights the developing story of Fed officials owning securities that the central bank purchased.

• Michael Saylor praises Bitcoin’s strength as a store of value by emphasizing its explosive performance relative to gold.

• Morgan Stanley (NYSE: MS) created a research team dedicated to cryptocurrencies and their impact on traditional markets.

What’s Next

The crypto market has been trading in a bit of a lull, but that’s to be expected after big positive moves and healthy pullbacks. Fundamentals are extremely strong, and the market should be gearing up for a rally after it finishes digesting its recent swings.

The U.S. Bureau of Labor Statistics (BLS) reported August’s inflation data this week, and consumer prices rose 0.3% from a month ago and 5.3% over the prior year.

The yearly increase is the fastest rate in 13 years, and reckless fiscal and monetary policies are pushing the problems down the road. The Fed and government officials are constantly downplaying inflationary risks, but the data has told a different story.

Institutions and retail investors are hedging against future fallout by jumping into crypto, and Bitcoin’s absolute supply cap prevents some of the issues that stem from printing trillions of dollars.

Crypto adoption is soaring, and those left out will wish they had exposure.

One potentially great way is by checking out my colleague Juan Villaverde’s Weiss Crypto Investor. I highly recommend you check it out now.

Best,

Sam