Blockchain: Meet the New Superhero of the Datasphere

|

Politics and investing are often intertwined, and my inbox has been filled with questions and warnings about the Trump impeachment proceedings.

But none of that political noise is going to stop or even slow down the growing tsunami of traffic that is zooming over the internet.

Heck, it's likely this is only going to attract MORE people to news, opinion and social media sites … and potentially, a lot more often.

I'm not just talking about articles, photos and funny (or not-so-funny) memes. The world is creating zillions of bytes of new data every day.

Some 90% of the world’s data — from the beginning of recorded history until now — has been created in just the past two years.

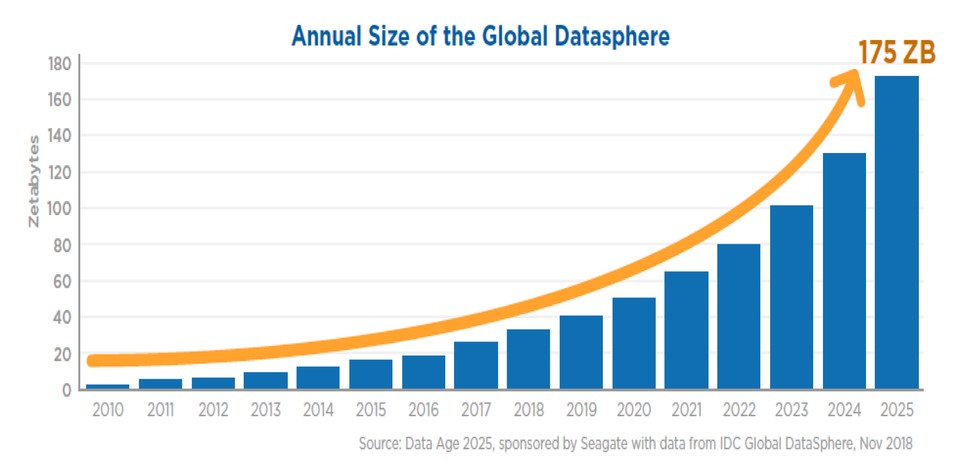

And we ain't seen nothin' yet. The sum of the world’s data, called the Global Datasphere, continues to grow at an exponential rate.

|

Through the use of Big Data and artificial intelligence, it has also become incredibly valuable … and incredibly dangerous. Concerns about security, storage and governance of that data are a real threat to your personal privacy.

Something has to be done to protect all that data …

Blockchain’s distributed ledger technology solves the trust and safety issues of big data and artificial intelligence.

For example, a hospital can use blockchain to store and secure patient data, keep it up-to-date and provide access only to approved parties such as doctors, nurses, pharmacists, billing departments, insurance companies and Medicare.

Related post: Could blockchain have stopped El Chapo?

Once on the blockchain, anybody who wants to access the data will need multiple permissions from other points in the network to access it.

This would make it impossible for cybercriminals to hack into your personal data.

A byproduct of blockchain’s security: the huge profits that blockchain service providers will make.

According to the NYC Data Science Academy:

Big Data is an incredibly profitable business, with revenues expected to grow to $203 billion by 2020.

The data within the blockchain is predicted to be worth trillions of dollars as it continues to make its way into banking, micropayments, remittances, and other financial services.

In fact, the blockchain ledger could be worth up to 20% of the total big data market by 2030, producing up to $100 billion in annual revenue.

$100 billion in annual revenue!

There are some publicly traded stocks that I think have the potential to triple, quintuple, or even increase by tenfold over the next few years. But the easiest way to invest in the cryptocurrency food chain is with ETFs. There are four ETFs you can consider.

• Amplify Transformational Data Sharing ETF (BLOK)

• Reality Shares Nasdaq NexGen Economy ETF (BLCN)

• First Trust Indxx Innovative Transaction & Process ETF (LEGR)

• Innovation Shares NextGen Protocol ETF (KOIN)

One of these ETFs is a cornerstone recommendation in my Weiss Crypto Investor newsletter. Not only have we been in this trade the longest, but I also recommend an outsized allocation to it.

Want all the details? Click here to start your blockchain investing journey alongside me.

Best wishes,

Tony Sagami