Blockchain Tech Will Disrupt This $689 Billion Business ... and YOU Can Profit

|

"Crypto[currency] is a far better way to transfer value than pieces of paper, that's for sure."

-- Elon Musk

There is no shortage of hoopla surrounding the immigration situation at the U.S.-Mexico border.

Different people have different reasons for wanting to come to the United States. But my guess is that the primary reason the wannabe-immigrants are amassing at our southern border is money.

Plain and simple, they are desperate to improve their financial situation in life.

That is why my grandfather, Fusakichi Sagami, left Hiroshima in 1892 for Tacoma, Wash. Japan was a poor, feudal country and America was known as the land of opportunity even back then.

My grandfather never did strike it rich, but he made enough from his Western Washington vegetable farm to send a few gold coins to his relatives in Japan. I am sure those coins made a monumental difference in the quality of their hardscrabble lives.

|

| Fusakichi Sagami, upper left, with my father, Ken, standing next to him. |

That same flow of money from immigrants in the U.S. to their poor relatives in lesser-developed countries is still going on today. And in a big, big way.

The next time you visit a national grocery store, take a peek at all the people standing in line at the Western Union booth. You'll see exactly what I mean.

Those remittances — or money that's sent to another party, usually one who is in another country — are big, big business.

How big? The World Bank estimated that cash remittances from developed countries to less-developed countries reached $528 billion last year.

That amount is expected to reach $689 billion this year. And some $6.5 trillion will be sent to lesser-developed countries over the next 15 years.

What countries are all these billions flowing to? The largest recipient was India with $62.7 billion, followed by China ($61 billion), the Philippines ($30 billion), Mexico ($28.5 billion) and Pakistan ($20 billion).

Those figures came from the United Nations. Gilbert Houngbo, director of the UN's International Fund for Agricultural Development, underscored the huge impact of this fund flow:

"The small amounts of $200 or $300 that each migrant sends home make up about 60% of the family's household income, and this makes an enormous difference in their lives and the communities in which they live."

Unfortunately, sending that money isn't cheap. The average cost of sending $200 was $13.80, or 6.9%, last year.

In December, I was in Malta and while waiting in line to exchange a couple hundred U.S. dollars, I watched a man pay 13 euros in fees to send 50 euros to somebody in Nigeria.

Awful!

Related post: 3 things my vegetable farmer father taught me about investing

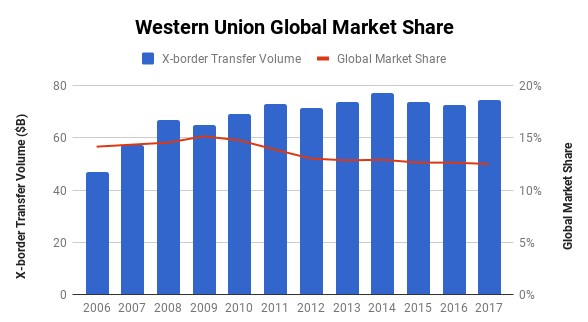

The big dog in the money transfer business is The Western Union Co. (WU). It has more than 33,000 physical locations in over 200 countries, transferred more than $70 billion last year, and pulled in $5.9 billion of fees for doing so!

|

That's a lot of moolah to pay a middleman, and Western Union should be shaking in its boots because blockchain technology is about to put a serious dent in its business.

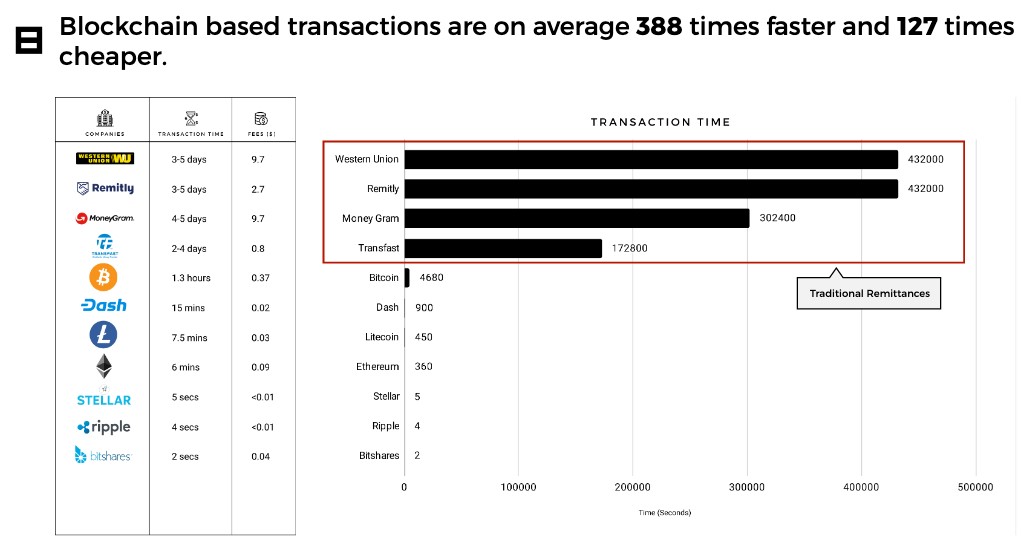

The reason is simple: Innovative blockchain-based companies can transfer money around the world FASTER and CHEAPER.

Not just a little faster and little cheaper, but rather a LOT faster and a LOT cheaper: 388 times faster and 127 cheaper!

|

Western Union isn't blind, which is why it is frantically exploring ways to include cryptocurrencies and blockchain technology in its services.

But Western Union isn't the only middleman that is about to get its legs chopped off by faster, cheaper blockchain competitors.

All kinds of brokers— bankers, stock brokerages, real estate title companies, cybersecurity, ride sharing, auto sales/rentals and insurance, for example — are going to see their profit margins shrink to fractions of what they are today.

Consumers, like the Nigerian man in Malta, will save mountains of money. And savvy investors who load up on the blockchain innovators will make a mountain of money.

Who are those blockchain winners? The blockchain industry is young and growing by the day. But I think the best way to invest is to own a combination of the technology behemoths that are making blockchain a central part of the business — like IBM — and a basket of blockchain upstarts via a blockchain ETF. (Here are four blockchain-focused ETFs you can consider buying today.)

That barbell of youth and experience should deliver life-changing profits.

Best wishes,

Tony Sagami