Heads up: We are getting ready to publish, for the first time, our sub-grades that are behind each and every one of our 93 cryptocurrency ratings:

• One grade for technology and adoption — primarily geared to long-term investing

• One grade for investment risk and reward — especially important for short-term trading

• And, as before, an overall rating that combines the two

Check your inbox or our website on Tuesday, May 29. As a reader of this service, you’ll be among the first to get our press release with a solid sample of the grades.

Or better yet, if you subscribe to our Weiss Cryptocurrency Ratings service, you will get the full list tomorrow.

Given the big, solid bottom we see in the crypto market, and given the low we expect in early June, the timing couldn’t be better. But …

Crypto Naysayers Still Don’t Get It

Many of them argue that cryptocurrencies will never be accepted as a valid form of money because governments can just pass laws to outlaw them.

“You know, like China did,” goes their mantra.

But they seem to be ignoring the actual, on-the-ground consequences of such “bans” and how easily they can backfire.

Let’s take a quick round-the-world tour, and I’ll show you exactly what I mean, starting with China.

The Chinese authorities didn’t pussyfoot around. They went straight for the jugular vein — the cryptocurrency exchanges.

This made sense, or so they thought. Exchanges are formal companies that need to be compliant with the regulatory framework of the countries where they operate.

But here’s what they missed: For a population to adopt cryptocurrencies, they don’t need exchanges.

Are the exchanges convenient? Yes. A dire necessity? No.

In fact, as I’ll explain in a moment, they are just one of the ways you can exchange your government-sponsored fiat money into cryptocurrency.

Then, once you’ve completed that initial trade, you’re up in crypto-space. You can teleport your money anywhere you want. Your transactions are almost entirely outside the regulatory reach of any country on Earth.

This doesn’t mean that cryptocurrencies live in a Martian No Man’s Land. They do follow a set of bylaws. The difference is, they’re not the edicts or directives by any central authority. Instead …

The only rules that apply to a public distributed ledger are the rules of consensus that exist within its network. Nothing else.

In the parlance of the SEC or CFTC, you might say that cryptocurrency networks are intensely rigorous — but amorphous — self-regulatory organizations.

So what was the net effect of the so-called Chinese ban on cryptocurrencies?

Beijing was unable to outlaw the possession of crypto assets; it’s almost impossible to even track down who owns what where.

Reason: By their very design, cryptocurrency networks are anonymous, or at most, pseudonymous.

The latter means that, although each account and the amount held is public information, it’s not possible to directly tie the ownership of these accounts to any one individual.

This is not to say that banning exchanges has no effect whatsoever. But so far …

The only significant effect of crypto bans has been to drive traders to over-the-counter (OTC) trading platforms.

If established exchanges are not available, people simply move to specialized social media sites and similar applications.

|

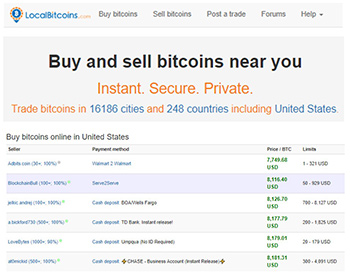

Consider websites like LocalBitcoins.com, for example.

It facilitates OTC Bitcoin trading. It provides a framework to agree on terms and reduce the risk that either side will run off with the money.

So what happens where cryptocurrency trading is officially “banned”? It merely transforms these kinds of platforms into de-facto over-the-counter (OTC) exchanges.

And it’s not just China. Similar crypto bans in countries like Venezuela and Zimbabwe have accomplished very little beyond making these platforms that much more popular.

Can governments shut down these as well? That would very difficult.

The parties meet anywhere — at a café, outside a bank, on a park bench. They agree to the terms. The fiat portion of the trade is carried out. And once the buyer has transferred the fiat via bank transfer (or even in cash), the seller releases the crypto.

Plus, for additional safety, both the fiat and the crypto can be locked in an escrow account under a smart contract.

Where Crypto Trading Is On The Street

Does it work? Absolutely! I know because I’ve personally done these over-the-counter trades.

My experience isn’t from a place where crypto is banned, but rather with a government that’s on the brink of default. As the authorities struggle to make ends meet and keep the lights on, they resort to draconian measures.

That’s the next stop on our tour: Argentina, where the government has imposed a whopping 31.5% tax on international transactions.

Think about that. It means that every time you want to use the banking system to get your money out of the country, the government takes nearly a one-third cut.

Maybe you just want to make an online purchase of an airline ticket from a foreign carrier. Perhaps it’s just the latest smartphone not yet offered in local stores. It doesn’t matter. If the money leaves Argentina, you pay the tax.

Or, consider the plight of business people. My father, for example, does business with companies based in Argentina. Whenever he brings the money home, the tax is the equivalent of a massive confiscation with practically zero hope it will end anytime soon.

So to give him a hand, I went to Argentina to see how hard it would be to locate someone trading pesos for Bitcoin. As it turned out, not only did I find individuals, I also found local dealers.

“If you want to buy Bitcoin,” said one, “you pay us 15% over market. If you want to sell, we pay you at least 10% over market.”

I did even better than the 10%. Bitcoin was selling for about $6,000 at the time, and I got between $6,800 and $7,000. The people I dealt with told me they’d buy as much crypto as I could lay my hands on.

Meanwhile, the dealers’ business model makes a lot of sense and is in big demand. They have high-net-worth clients looking to get their money out of the country. In big amounts and FAST.

So the dealers keep a healthy stash of cryptocurrency on hand, offering their customers the ability to get their money out of the country while bypassing the banking system. Instead of paying the government’s outrageous 31.5% tax, the customers are glad to pay the dealer his 15%.

That’s a big change from years ago! When countries imposed capital controls, they could ban black market dealers and throw them into jail. Business people would dress like hippies, stuff their backpacks with currency and try walking across the border. Border agents caught them frequently, and the controls were often effective.

Not now! Not in the crypto age! What’s happening in Argentina is happening in every country that tries to impose currency controls … which takes us to Iran.

That was the topic of my post one week ago: “Iran Crisis: The Real Consequences No One’s Talking About.” I wrote about the collapse in the Iranian rial, about capital rushing out of the country and the surging demand for cryptocurrencies as the flight vehicle.

In response, journalists have asked us how we can validate that kind of news. (It originally came out of the Iranian Parliament.)

|

| Click image for a larger view. |

Needless to say, I can’t just take a day off to roam around Tehran’s Grand Bazaar. But I was able to visit the same OTC platforms I used for Argentina and explored Iran’s Bitcoin market in cyberspace.

What I saw was Bitcoin trading in Iran at premiums that made the 15% in Argentina seem tame by comparison.

In fact, I found Bitcoin sellers in Iran asking for premiums of 40% — even 50% — above market.

And those exorbitant premiums can only mean one thing: Many Iranians are panicking. And they’re using cryptocurrency to move money out of the country.

So, in the final analysis …

What are governments accomplishing with their bans, rules and controls?

They’re helping to increase awareness of cryptocurrencies. They’re making crypto more popular.

Maybe we should send them a thank-you email: “Keep up the good work, guys.”

And to celebrate the occasion, maybe you should buy more crypto.

As I said at the outset, we’re celebrating a different way: We’re getting ready to disclose the sub-grades that make up our overall ratings — one for investment risk and reward that’s geared to short-term trading, and one for technology and adoption that’s mostly for long-term investing.

Best,

Juan