Crypto Assets Stabilize and Rally Off Mid-Week Lows

There was more “red” in crypto markets over the seven days through Thursday, as the down-move we pointed out last week carried into the new one.

There is a noteworthy difference. Last week, we saw a clear downtrend, with all of our crypto indexes down double-digits from their peaks.

This week, we see the opposite, as most crypto assets managed to rally off their lows and stabilize and rally into the trading week’s end.

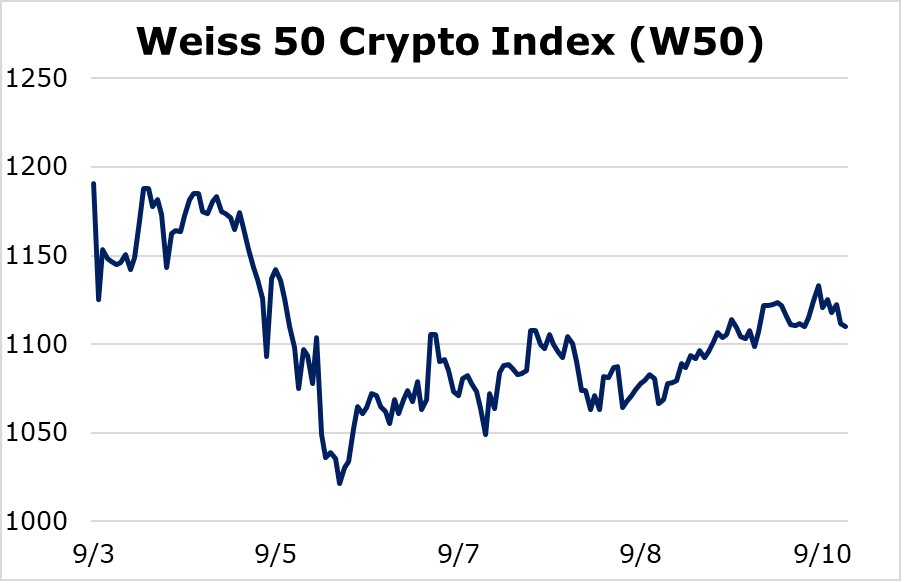

The Weiss 50 Crypto Index (W50) — the broadest industry benchmark — finished the week down 6.75%. But it did claw back from a double-digit mid-week loss. And note that the chart below basically shows sideways movement, however dramatic the in-between days.

The same basic pattern shows up when we strip out Bitcoin (BTC, Tech/Adoption Grade “A-”).. Weiss 50 Ex-BTC Crypto Index (W50X) was down 8.76%, though it was down more than 13% early in the week.

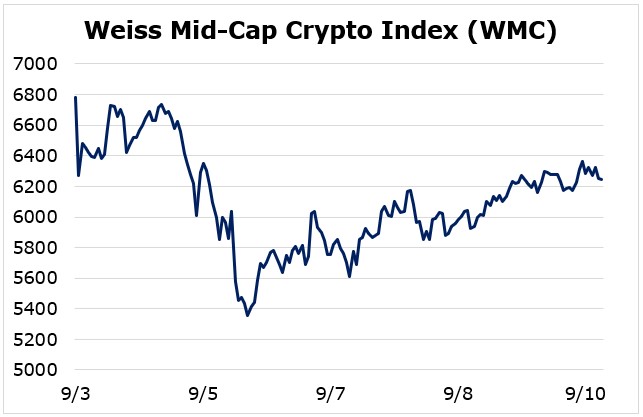

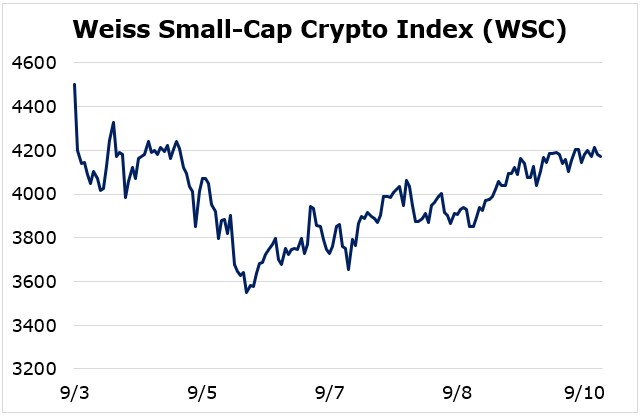

Breaking down the industry by market capitalization has a similar effect this week by taking out Bitcoin: We see similar patterns.

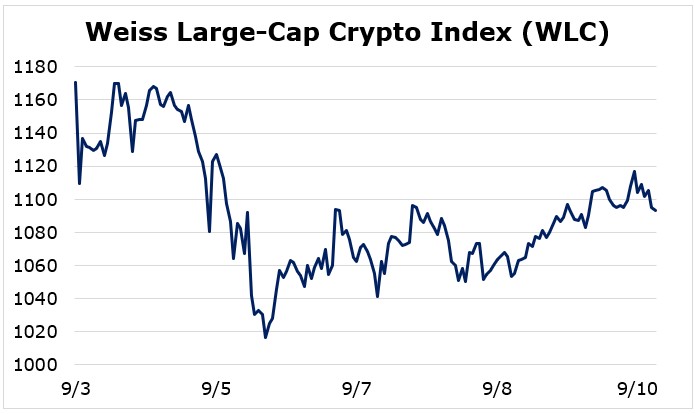

The Weiss Large Cap Crypto Index (WLC) was down 6.57% after recovering from mid-week depths.

The Weiss Mid-Cap Crypto Index (WMC) also rallied from lows to finish the seven-day trading week down 7.96%.

And, finally, the Weiss Small-Cap Crypto Index (WSC) closed out the sequence, shedding 7.29% but recovering from its weekly bottom.

No matter what section of the market we look at, we see the same pattern: a selloff early, a rally in the middle and consolidation as the week came to an end.

With Bitcoin hovering at 10,000 — a key psychological level — and Ethereum finding a floor around the 350 area, it would seem crypto assets are primed for a bounce here.

In addition, our timing models also point to a likely low being established in the short term.

The key for the bulls in the next few days and weeks will be whether Bitcoin can hold strong at 10,000 and rally off that level in the not-too-distant future.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.