Crypto Bull Heats Up as Indices Break Key Resistance

|

Important: Did you miss our landmark white paper about the future of crypto? If so, be sure to go here before we take it offline. (There’s no charge.) |

|

We saw some big fireworks in cryptoland this week!

All our indices are up by double digits. And we’re seeing clear signs that crypto traders and investors are feeling more confident in crypto as a whole.

The key change: The Weiss Crypto Indexes have broken above key resistance levels. And our models are telling this breakout could later usher in a substantial rally.

I’ll let our charts do the talking from here …

Let’s start with our broadest metric, the Weiss 50 Crypto Index (W50), up a respectable 11.5% in the week ending Thursday.

|

What’s interesting is this latest run was almost entirely led by altcoins.

We can see the altcoin strength when we look at the Weiss 50 Ex-BTC Crypto Index (W50X), which is identical to the Weiss 50 except for the fact that it excludes Bitcoin (BTC, Rated “A-”). This index surged by 20.56%, nearly double the performance of the index that includes BTC.

Clearly, the drag was caused by Bitcoin’s underperformance.

|

The same pattern emerges when we break down the industry by market cap:

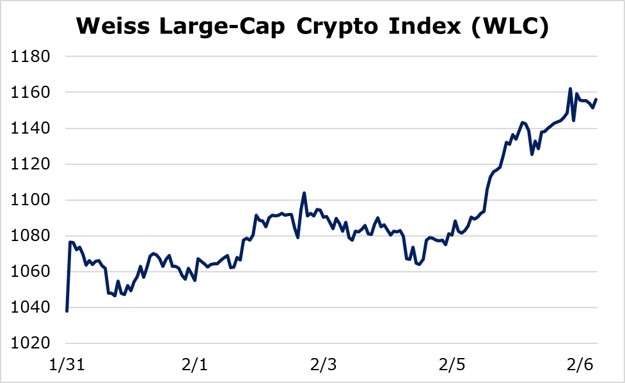

- The Weiss Large Cap Crypto Index (WLC) is up 11.35% this week. Just like with the Weiss 50 Crypto Index, this index lagged due to Bitcoin’s relative underperformance.

|

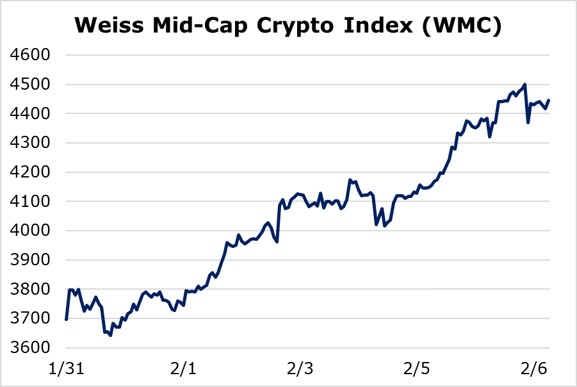

- The Weiss Mid Cap Crypto Index (WMC) surged 20.28% — in line with the Weiss 50 Ex-BTC Crypto Index.

|

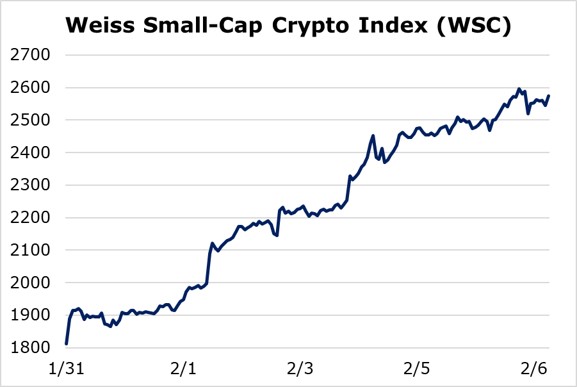

- The clincher: The Weiss Small Cap Crypto Index (WSC) jumped by a whopping 42.08%. After weeks of lagging behind, the small caps caught up and then some.

|

No matter how we break up the industry, the picture is the same: Large caps — primarily Bitcoin — lagged while smaller, riskier names outperformed.

That tells us that crypto assets have shifted markedly into a “risk on” environment.

It’s a recurring cycle we’ve seen in crypto markets repeatedly in the past:

First, the most conservative, “safe” crypto assets move higher. Names like Bitcoin or Ethereum (ETH, Rated “A-”) begin to attract capital.

Second, investors begin to gain confidence about all things crypto.

Third, they shift their focus to beaten down, alternative names that they predict will deliver the best percentage gains.

Finally, it becomes a self-fulfilling prophecy. The more they buy, the greater the price surge, and vice-versa.

This is when altcoins really begin to outperform.

And this is what happened in the past week, as small caps moved up the most, while large caps lagged.

A good sign? In the final stages of a bull market, no.

But in the early stages of a bull market like we’re in today, yes.

It tells us crypto assets are gearing up for a potentially spectacular 2020.

Now that short-term resistance is clear, the next major target is the 2019 highs. Once assets clear those key levels, we can begin to envision crypto asset prices at all-time highs again.

One word of caution: This week’s action is also a sign that we’re nearing the end of a short-term trading cycle. So, don’t be surprised if we soon witness a short-term correction.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.