|

Last week, we stressed how the Weiss Crypto Price Indexes blasted clear through critical resistance levels and how they paved the way for a further, accelerated move to the upside.

This week, that’s precisely what we got!

To casual observers, this rally, which began in mid-December, may feel like the big crypto rallies of 2019. But ...

The current rally is actually quite different: Back in 2019, it was led mostly by Bitcoin and the biggest names. This time, it’s largely led by the risker names. And this “risk-on” environment is a telltale sign of confidence returning to crypto.

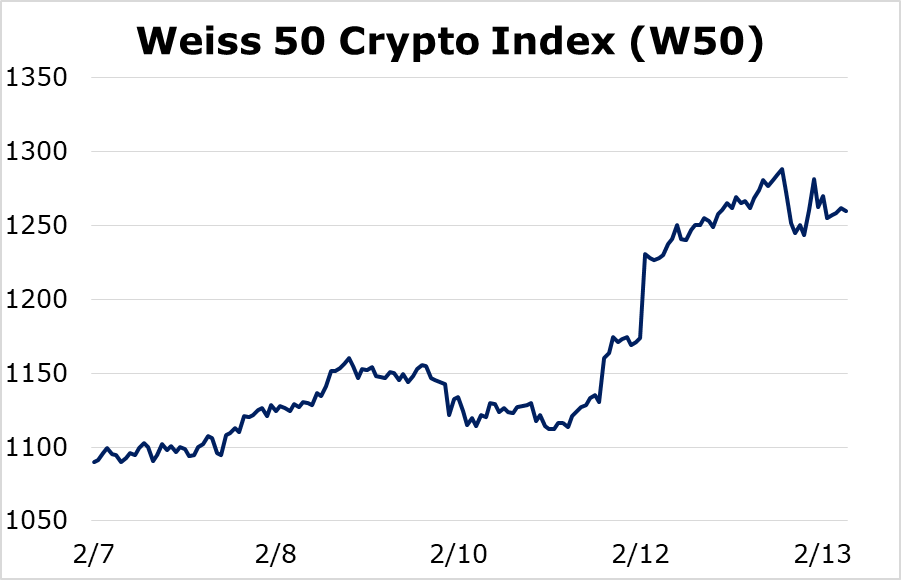

To understand how, let’s start with a broad overview of the markets for the week that ended Thursday, Feb. 13. For this we turn to our Weiss 50 Crypto Index (W50), which was up 15.61%.

|

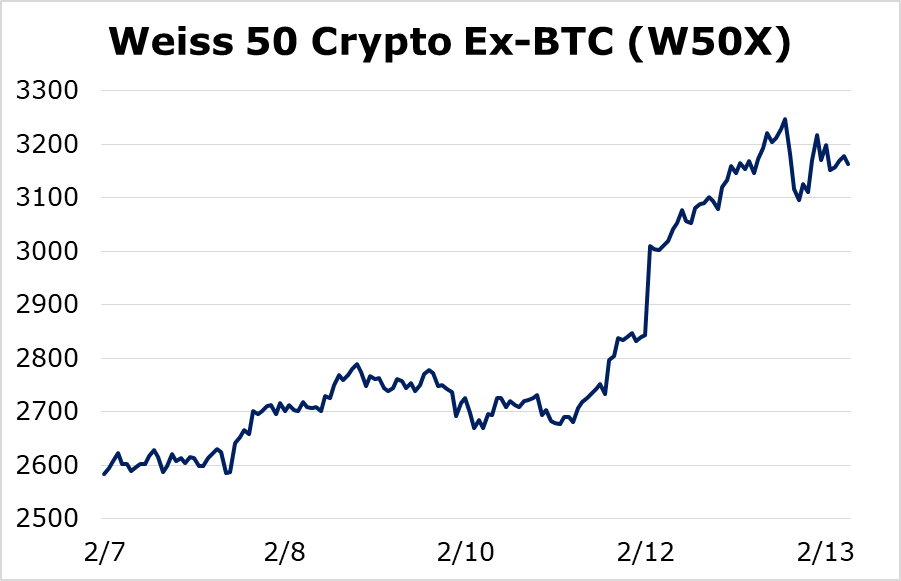

Looking at the space minus Bitcoin, we find that the Weiss 50 Ex-BTC Crypto Index (W50X) was up 22.43% on the week, led largely by Ethereum which surged 33%.

|

Splitting the markets by market cap, we find more evidence of the risk-on environment:

First, the Weiss Large-Cap Crypto (WLC) Index was up 14.74%.

|

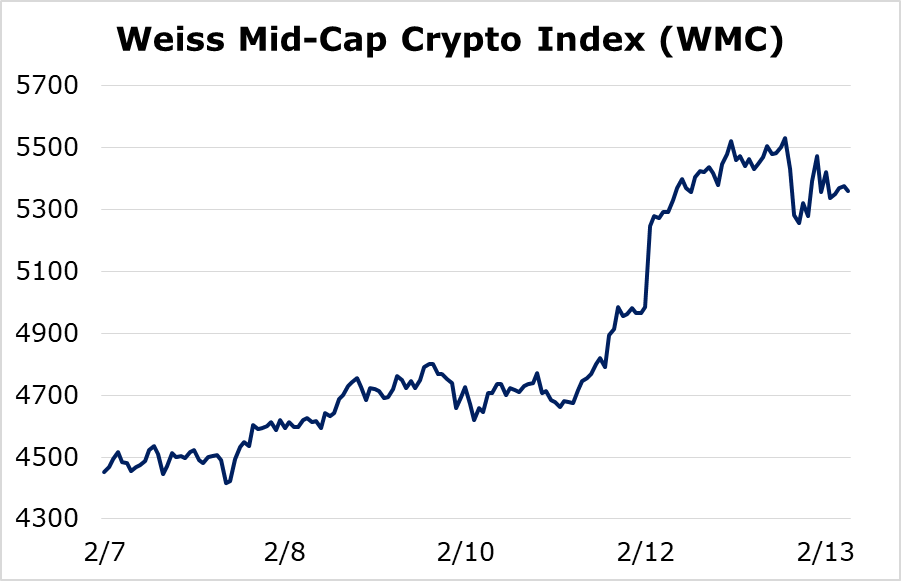

The Weiss Mid-Cap Crypto Index (WMC) was up even more — 20.36% on the week.

|

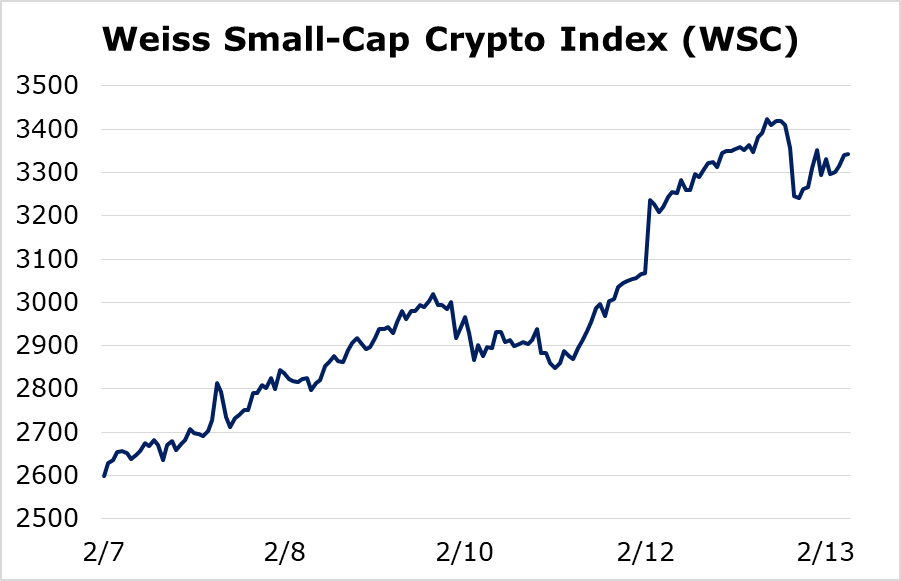

And third, the Weiss Small-Cap Crypto Index (WSC) beat them all, up a hefty 28.61%.

|

Once again, the smallest (and riskiest names) are leading the charge higher ... the large caps underperform ... and the mid-caps track between the two.

This is critical. So, it bears repeating:

- Back in early 2019, Bitcoin pulled crypto markets from the depths of the 2018 bear market almost singlehandedly.

- Now, one year later, precisely the opposite is happening: The altcoins are jumping ahead, while Bitcoin struggles to play catch-up.

Crypto traders call this “altcoin season.” I say ...

It’s the kick-off of the second major phase of the bull market that began just over one year ago.

It promises to be long-term and sustainable.

And, with the Bitcoin halving expected in May, it could heat up still further in the first half of 2020.

One caveat: All this has helped postpone a long-overdue short-term correction. But our model continues to signal overbought conditions for now. So, don’t be surprised if you see a price pullback that’s sharp but brief.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.