Crypto Bull on Pause. Short-term Pullback Looming? No Matter What, 2020 Crypto Bull Is Still on Its Way

|

At this time one week ago, crypto markets had just enjoyed one of the biggest and broadest one-week surges of the year.

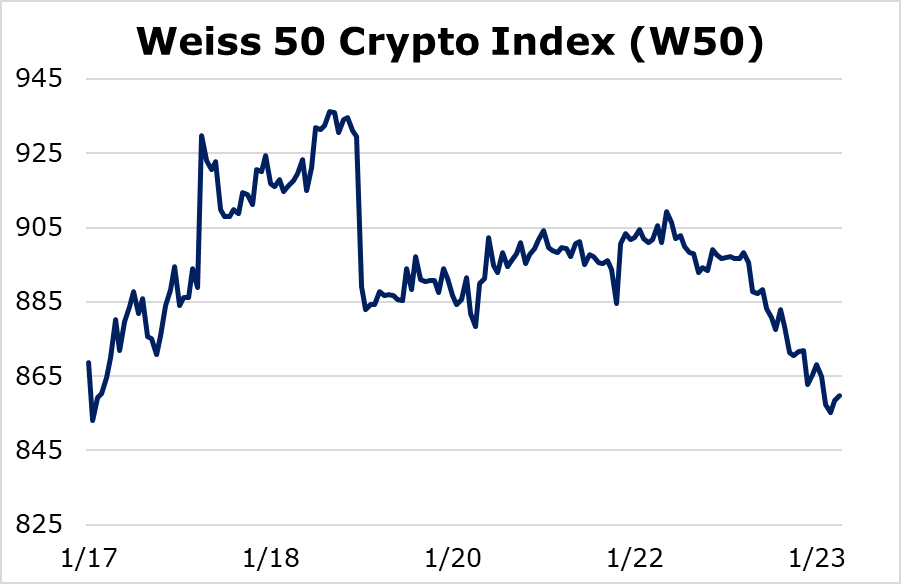

Our Weiss 50 Crypto Index (W50), the industry’s broadest price metric, had risen nearly 22%, while our Weiss Mid-Cap Crypto Index (WMC) had jumped by a whopping 44%.

So, it’s only natural for these assets to take a breather this week.

What does that portend for the near future?

After a big price surge with fireworks across the entire crypto marketplace, then a pause, a pullback is very possible. And our crypto cycles model is confirming that notion.

This week, the Weiss 50 Crypto Index was practically unchanged down just 1.03% as of Thursday’s close.

|

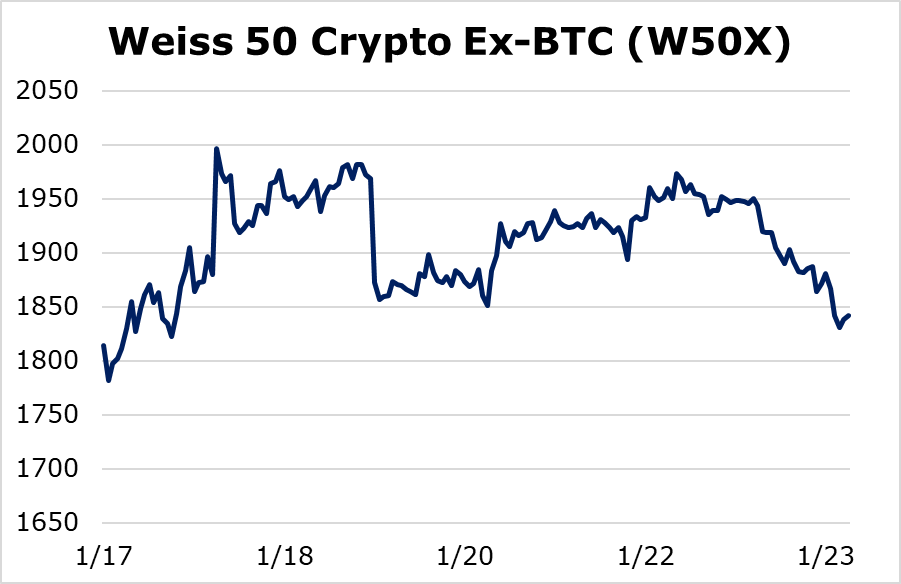

And the stall isn’t strictly a Bitcoin phenomenon. Even excluding Bitcoin, the Weiss 50 Crypto Ex-BTC Index (W50X) was only slightly more positive, up 1.58% on the week.

|

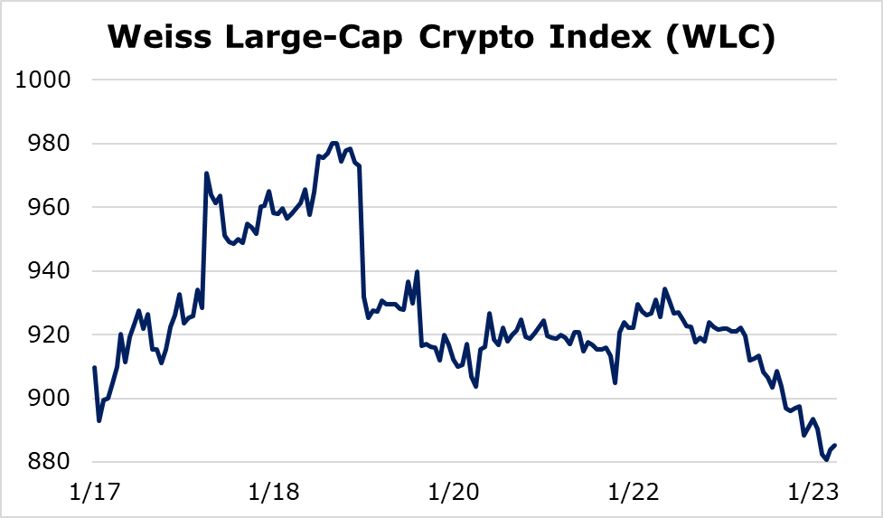

Splitting the markets by market cap confirms the sideways action:

The Weiss Large-Cap Crypto Index (WLC) was down 2.70%, led largely by Bitcoin’s minor underperformance on the week.

|

And the Weiss Mid-Cap Crypto Index truly tells the dead-zone story. It was virtually unchanged, up by a meager 0.03%.

|

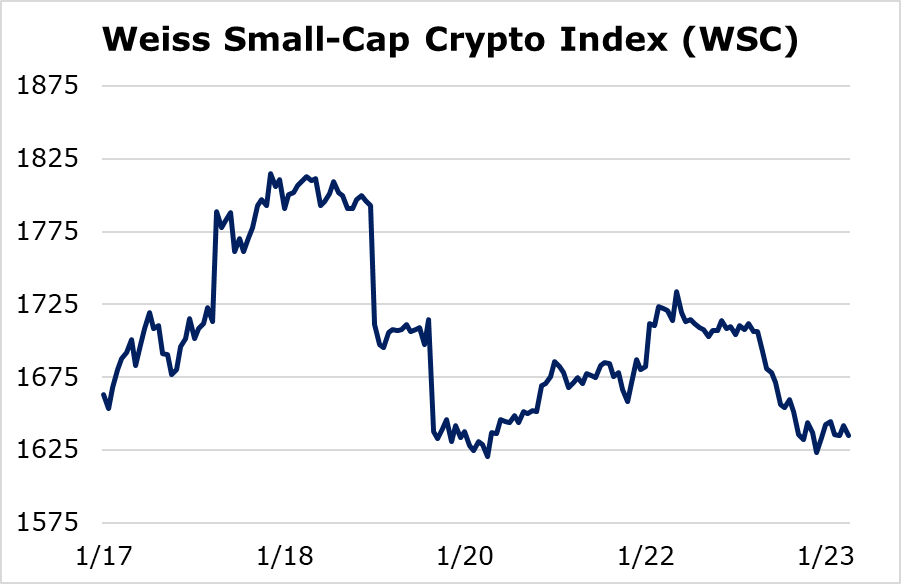

What about small cap cryptos? A tiny bit weaker, but nothing to make a difference. The Weiss Small-Cap Crypto Index (WSC) was down 1.71%. In the volatile world of crypto (especially small-cap coins), that’s also practically nothing.

|

Here’s the key: Rallies in all our crypto indexes ran out of steam when they were just shy of breaking key overhead resistance levels. Continued rising — even for just another week — would have signaled a much stronger rally was in the making.

The lack of this signal, coupled with the fact that the markets have not seen a significant pullback since mid-December, tells us that one may be due.

Long term, however the outlook remains firmly bullish. Our indexes and cycles model tell us that that momentum is building for a very positive 2020 across the entire crypto asset space.

But it’s not just our studies of price patterns that lead us to this conclusion. Industry fundamentals have also improved markedly.

For a full description of how and why — go here to add your name to our distribution list.

Then, we’ll immediately send you the link to our landmark white paper about the future of crypto.

Don’t delay. Because we’ll be taking it offline shortly.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.