Cryptos Start Year in Holding Pattern in Advance of Bitcoin Halving

If you don’t follow crypto, you might say this is simply the first year of the third decade in the third millennium.

But if you know what’s going on in the crypto world, you might describe it differently: It’s the first week in the year of the third Bitcoin halving.

That’s a big deal. Because in every prior halving, crypto prices followed a distinct pattern:

- They held firmly and rallied before the halving

- Then, they truly skyrocketed after the halving

That’s also the pattern we’ve seen in the current time frame; markets have mostly continued their path of sideways consolidation, which was also the dominating trend in the last few weeks of 2019.

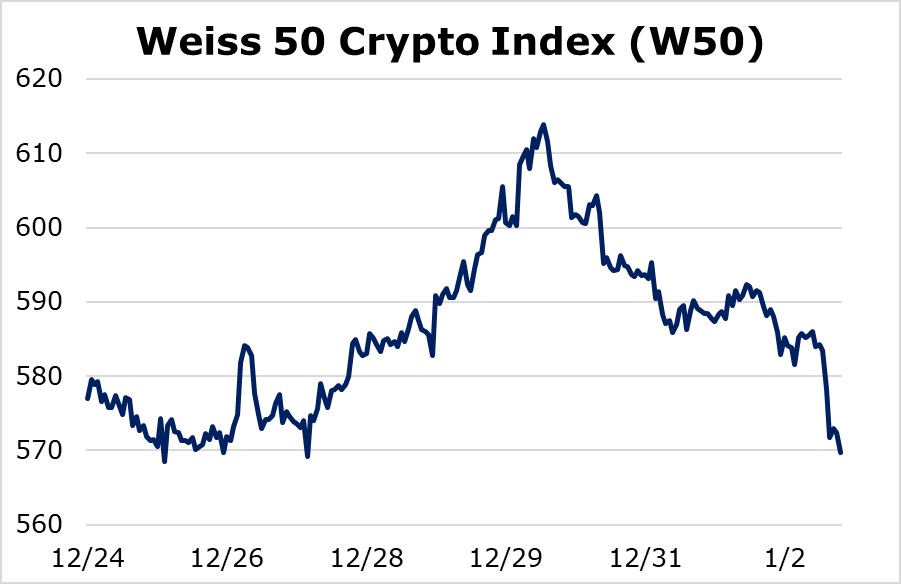

The quietness in the markets is captured perfectly by our leading Index, the Weiss 50 Crypto Index (W50), which was down just 1.25% on this week.

|

Furthermore, when we strip out Bitcoin — which can at times diverge from the rest of the space — we see the same pattern of sideways consolidation, as the Weiss 50 Ex-BTC Crypto Index (W50X) moved up a meager 1.05% on the week.

|

It’s worth noting that both these indices rallied into the middle of the week only to sell off in the last couple of days. That’s very similar to the up-and-down action we saw in December 2019.

Splitting the markets by market cap, we find that:

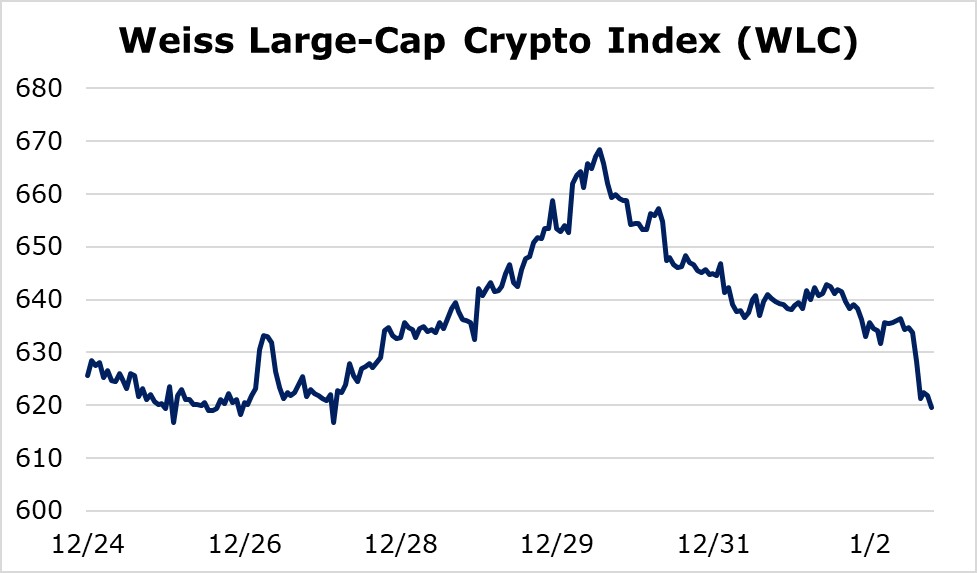

1) The Weiss Large-Cap Crypto Index (WLC) tracked the Weiss 50 very closely, down 0.96% on the week.

|

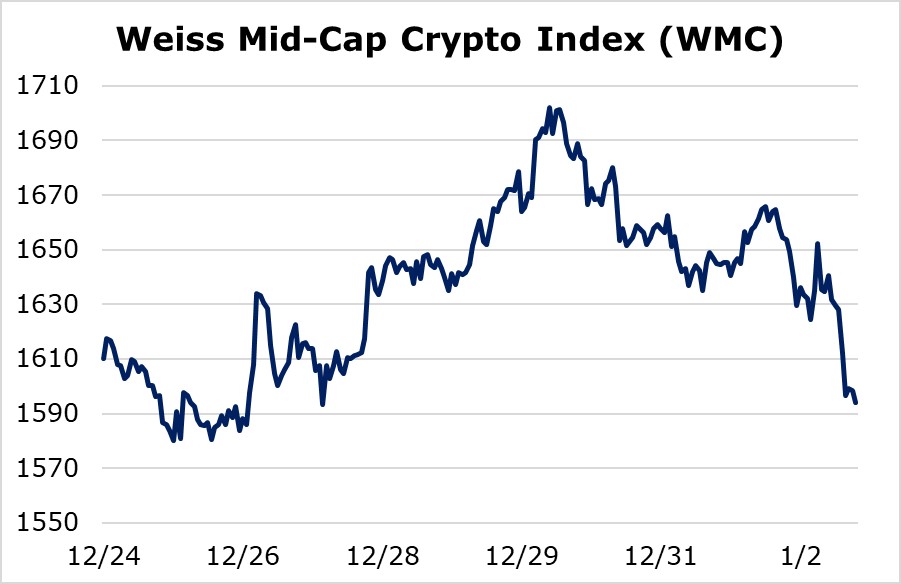

2) The Weiss Mid-Cap Crypto Index (WMC) was down about as much, off 1.00% on the week.

|

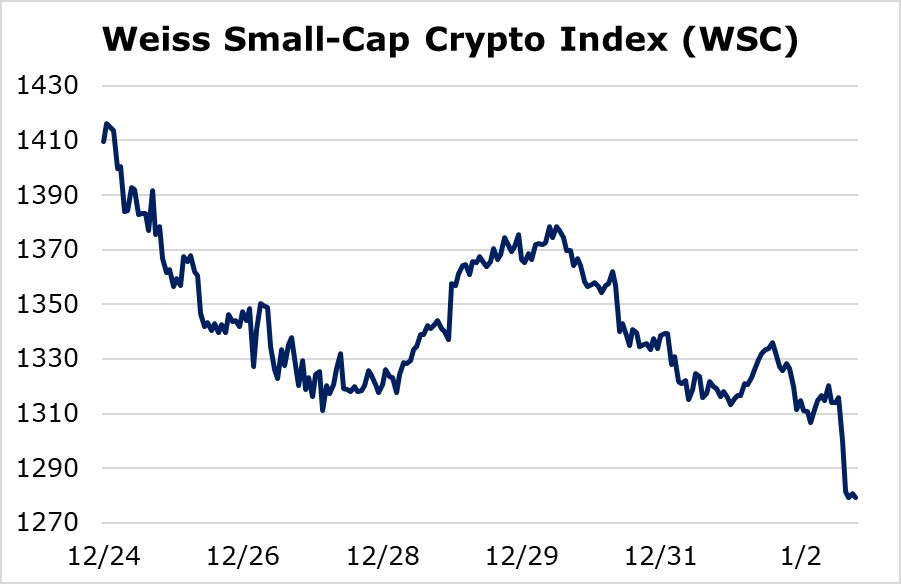

3) And the only outliers this week were the smaller altcoins, as the Weiss Small-Cap Crypto Index (WSC) fell 23%.

|

Even though the price action on the small caps was clearly lackluster, it’s worth pointing out that this index outperformed the rest of the markets in the entire month of December. So now they’re playing catch-up, bringing them closer into line with the rest of the crypto space.

Overall, we continue to see more sideways action in the near term, followed by an improving tone in the months ahead.

Here’s why:

First, most coins are already trading at or near their recent lows.

Second, our cyclical timing models point to an important rally likely to begin soon.

Third, all of this is part of a build-up for the upcoming Bitcoin halving in May of this year, which is likely to be a positive catalyst — not just for Bitcoin, but for crypto assets as a whole.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.