|

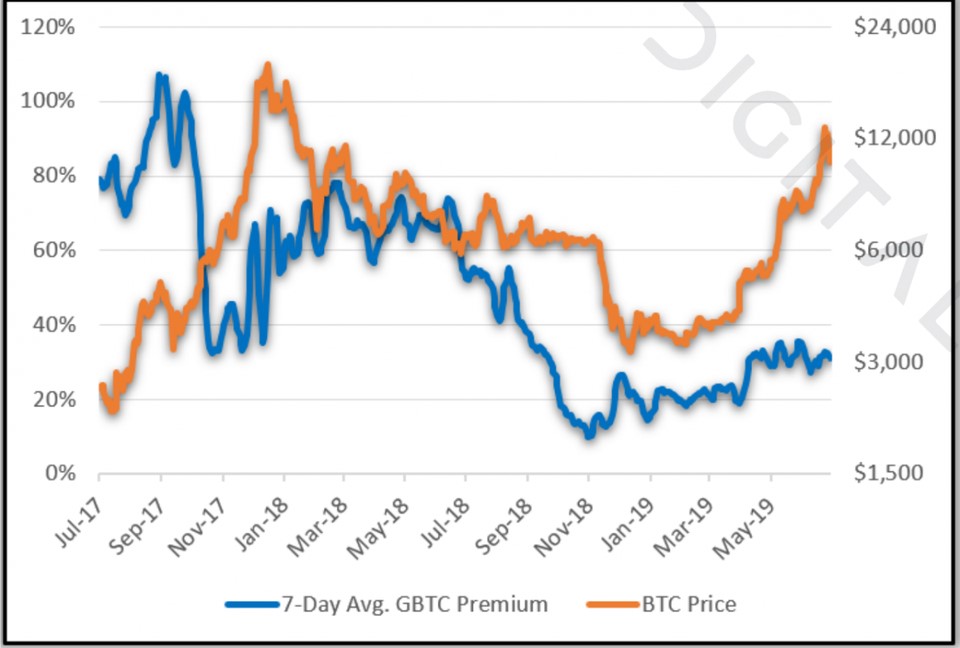

Bitcoin peaked at $19,783 on Dec. 17, 2017.

It's now trading well below that peak, but up sharply — more than 250% — from its December 2018 low of $3,122.

|

Investor interest in Bitcoin (as well as other cryptocurrencies) is picking up. But most of the public still considers Bitcoin and blockchain — the underlying technology that powers all cryptocurrencies — to be one and the same.

It's a classic mistake. For investors, it can also be a costly one.

Whether you’re a total newcomer to the cryptocurrency world or a long-time "hodler," know this …

Blockchain makes it possible for digital transactions not only to be verified, but also time-stamped and permanently stored in an impossible-to-modify "block."

This is similar to a page in an accounting ledger. Every block is linked to the preceding block to create a chain of records.

The true value of blockchain is that it allows you to trust people whom you've never met, without the use of a costly intermediaries.

I'm not saying Bitcoin isn't worth your attention. What I am saying is that the people running the biggest companies in the world are intensely interested in blockchain technology.

And the BIGGEST profits, in my opinion, will be made by investing in blockchain service providers.

That's because blockchain is quickly going from a "nice to have" to an urgent need for the business community.

How do we know this? They are telling us themselves!

Blockchain: 'Critical Priority'

A survey from Deloitte Consulting, its 2019 Global Blockchain Survey, found that more than half (53%) polled said that blockchain has become a critical priority for their organizations.

To large businesses, blockchain is quickly becoming as much of an IT priority as network upgrades, cloud transition, cybersecurity, big data, social media collaboration, Internet of Things and artificial intelligence.

According to International Data Corp., global blockchain spending will increase by an average of 76% a year between now and 2022 to $12.4 billion.

And that's just the United States. For the entire world, I've seen estimates as high as $41 billion.

What you want to do is invest in the blockchain pioneers and innovators that are going to be on the receiving end of that $41 billion.

To put that $41 billion in perspective, that is about twice as much as Kellogg pulls in each year. Yeah, we're talking about a LOT of money.

My point is simple:

Every crypto investor should own both cryptocurrencies AND blockchain stocks if he or she truly wants to ride the digital currency revolution.

And frankly, I expect the blockchain ride to not only be more profitable, but drastically less bumpy than cryptocurrencies. (Just take a look at the above Bitcoin price chart.)

What kind of companies am I talking about? Some of the big tech names you already know —Google, Microsoft, SAP and Amazon, for starters — but also hundreds of rapidly growing, aggressive start-ups you haven't (yet) heard of … which are exactly the type of companies that my Weiss Crypto Investor uncovers.

You don't have to believe me, but you should believe the 53% of the people running the biggest corporations in America.

Those are the biggest blockchain believers, and they aren't writing billion-dollar checks for giggles.

Best wishes,

Tony Sagami