Stablecoins: The Next Generation of Global Finance

|

This is simple, yes … but super, super important.

Cryptocurrencies perform two very different functions:

1) A storehouse of a value similar to gold, and ...

2) A medium of exchange like dollars and yen.

As you’ve seen, the price of Bitcoin (BTC), Ethereum (ETH) and other cryptocurrencies can fluctuate wildly in value. So does gold, silver, platinum and other assets that investors use to park their money.

That volatility, however, makes cryptocurrencies less than ideal as a medium of exchange. The restaurant owner who sells you a Denver omelet for $10 doesn’t want to the value of the Bitcoin he received drop to $9 by the time he closes out his books for the day.

A version category of cryptocurrencies, called “stablecoins,” are the next generation of digital money. Unlike Bitcoin, Ethereum and other altcoins (i.e., alternatives to Bitcoin), stablecoins are designed to substantially eliminate the volatility that has come to be associated with cryptocurrencies and

instead deliver stable value.

|

Stablecoins are on the path to becoming global, fiat-free money that is issued and tracked with blockchain technology.

How is this accomplished? By pegging the price of the stablecoin to something else, like the U.S. dollar or gold. This helps avoid the volatility we see in other cryptocurrencies.

In short, stablecoins provide the same benefits as Bitcoin but with a stable price that makes it possible to become a medium of exchange for everyday goods and services.

Related post: Stablecoins Will be Key to Smoothing Out Crypto Market Volatility

The potential for stablecoins is many times larger than Bitcoin. In fact, the market for stablecoins is essentially all the money in the world, or approximately $90 trillion.

It’s the holy grail of financial technology.

Stablecoins come in three basic types:

1) Crypto Collateralized stablecoins are backed by a mix of other decentralized crypto-assets.

The benefit of this method is that it is decentralized and out of the grasp of greedy, intrusive governments. These stablecoins are able to piggyback off well-established, public blockchain networks that offer full transparency by recording each and every transaction on an open and public ledger.

The downside is that any mix of crypto assets is still volatile and far from stable.

2) Commodity Collateralized stablecoins are backed by hard assets/commodities, usually gold. The issuing company holds an equivalent amount of legal tender reserves at reputable financial institutions.

3) Fiat Collateralized stablecoins are backed by an existing fiat currency. The issuing company holds an equivalent amount of legal tender reserves — most commonly U.S. dollars, euros and yen — at reputable financial institutions. Each stablecoin represents a proportionate 1-to-1 claim on the underlying assets.

|

Moreover, that stability is maintained through arbitrage opportunities. For example, if a stablecoin falls below its 1-to-1 peg, outside speculators could purchase the undervalued stablecoin at a discount — say 95 cents — and redeem it from the issuing entity for the full $1 value. The opposite is true if a fiat-backed stablecoin is trading above $1.

By being pegged to real-world assets, stablecoins avoid the wild price swings common in cryptocurrency markets. In short, stablecoins are the KEY to unlocking the power of blockchain technology and creating a new decentralized (government-free) global currency.

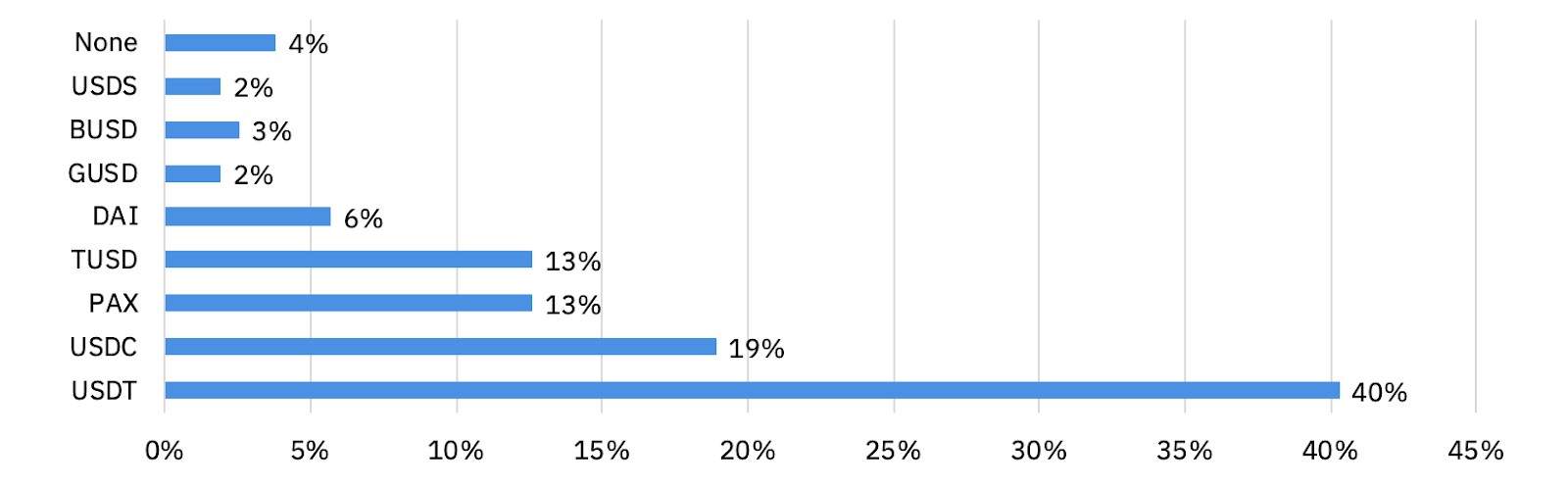

A recent survey from Binance found that 96% of its institutional clients are already using stablecoins. That’s right; a 96% adoption rate!

Stablecoins are going to revolutionize global financial and payment channels. But the question you should be asking is how can you make money from stablecoins if they don’t go up in value?

My answer: Stablecoins are set to replace money — dollars, yen or euros — as the world’s most popular medium of payment AND create a new core of global banking giants.

Related post: Stablecoins: The Future of Money?

What I expect is that a small handful of existing banks that own valuable blockchain payment patents — along with the help of cutting-edge software innovators — will be the big (and I mean REALLY, REALLY big) winners.

Stablecoins may not change in value, but a carefully selected portfolio of stablecoin-payment kingpins is going to SKYROCKET. And my Weiss Crypto Investor subscribers will be among the first to know about those and other companies that aren't just riding the trend but that are actually making the waves.

Smart investors should be on the lookout now for forward-looking companies that are already turning to blockchain technology.

Best wishes,

Tony Sagami