Stop Treating Your House Like an ATM with Blockchain

|

Do not treat your house like an ATM!

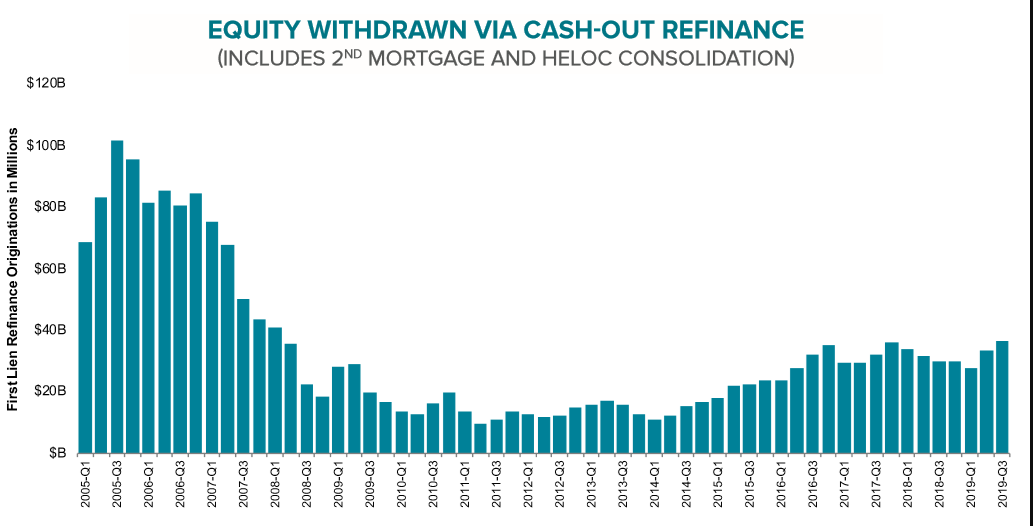

According to mortgage watchdog Black Knight, Americans are tapping the equity in their houses to buy things they can’t afford.

Just like in the years leading up to the 2008-'09 financial crisis and housing bust.

In the third quarter of 2019, refinance volume jumped by 132% to its highest level in three years. Some — but not much — of that refinance volume was used to lock in lower interest rates. That’s the smart way to refinance.

However, a lot of it was to pull cash out to pay for things like remodels, vacations, new cars or second homes.

|

|

Source: Calculated Risk |

Cash-out refinances accounted for one-in-five of all refinances in the first two quarters of this 2019. That then jumped to one-third in the third quarter.

Cash-out refinances are up 24% over a year prior. Danger! Danger!

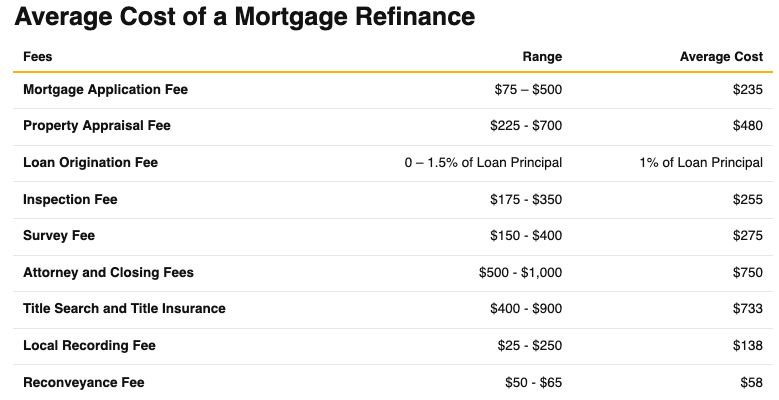

Refinancing a mortgage isn’t free, despite what some mortgage brokers may tell you. According to Value Penguin, the average cost of refinancing a mortgage is $4,345.

|

|

Source: Value Penguin |

Mortgage brokers that advertise “no cost” refinances fold the fees into a higher interest rate, bump your total mortgage amount or increase the monthly payments of the new mortgage.

There is no “free lunch” in the mortgage business.

The good news is that blockchain is about to dramatically lower the cost of refinancing your mortgage.

Blockchain, aka Distributed Ledger Technology (DLT), makes it possible to store all the vast paperwork documents that need be conveyed between all the parties involved in creating a mortgage, create a transparent audit trail, speed up verifications and eliminate mountains of paperwork.

The savings will be enormous. How enormous? According to a 2018 study from Moody’s, blockchain will reduce the operational cost of making a loan by over $1 billion.

Some mortgage companies are diving headfirst into incorporating blockchain into their business model and are going to leave their competition in the dust and rack of gigantic profits in the process.

Frankly, I’m not sure what banks are going to be the big blockchain winners, but I do know that the companies that are being hired by banks to incorporate blockchain technology into their computer networks are already making zillions.

That’s the way to become a blockchain millionaire.

And if you’re still pulling money out of your house to buy things you can’t afford ... stop it!

Best wishes,

Tony Sagami