The direction of crypto markets can flip flop frequently — from bullish to neutral, neutral to bearish and then back to bullish again.

Sometimes the change is blatantly obvious, as in December 2017 when Bitcoin crashed … and again in December 2018, when it hit rock bottom.

But on other occasions, the shift is more gradual and subtle, as it has been recently.

Just two weeks ago, for example, crypto markets had a distinctly bearish tone. But last week, they held at critical levels and rallied. And this week, we again see some minor weakness, as intraday volatility contracts and prices hover above late-November lows.

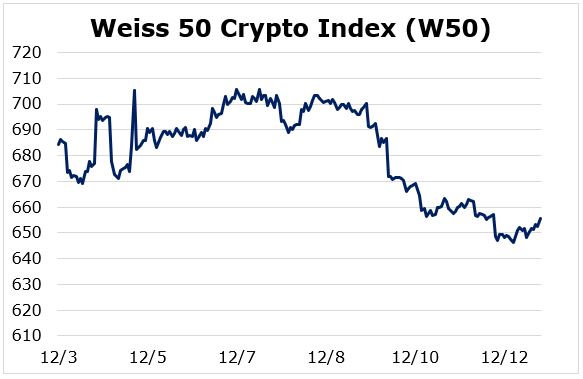

The Weiss 50 Crypto Index (W50), representing the broadest possible view of the industry, is down 4.17% for the week ending yesterday. Last week, the index was up by a similar amount.

|

When we strip out Bitcoin and look at the Weiss 50 Ex-BTC Crypto Index (W50X), we see the same picture — down 4.12%.

|

But segmenting the sector by market cap, we see an interesting wrinkle:

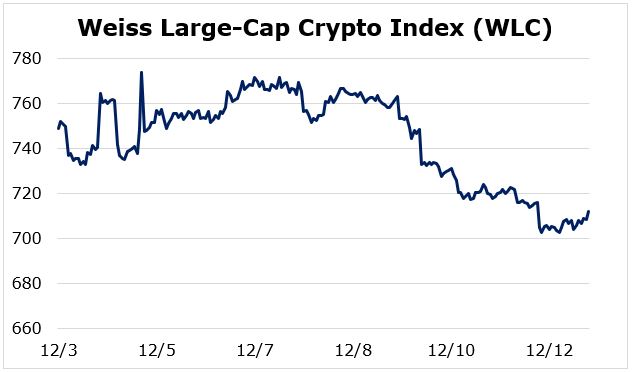

The Weiss Large-Cap Crypto Index (WLC) was DOWN 4.95% …

|

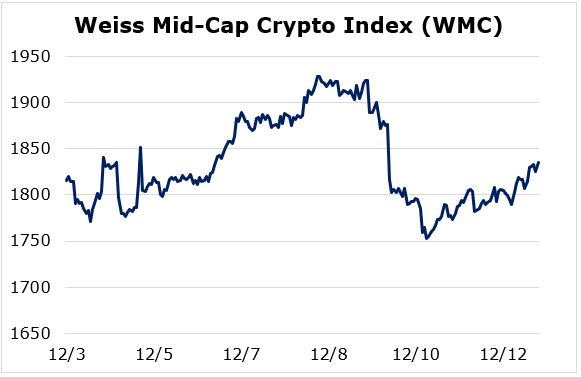

The Weiss Mid-Cap Crypto Index (WMC) was UP 1.07%, and …

|

The Weiss Small-Cap Crypto Index (WSC) was down 5.25%.

|

This is not a common occurrence. Typically, either we see ..

- Small caps leading, which denotes a risk-on environment in the crypto markets as investor sentiment becomes more speculative and assets move from Bitcoin and other large-cap coins to smaller, riskier coins. Or …

- Large caps leading, which denotes a risk-off environment, as investor sentiment turns more conservative and assets move in the opposite direction.

But this week, we saw small caps and large caps trading down in sync, while mid caps rose.

So we delved down a bit deeper to uncover the reason.

It was Tezos! This mid-cap coin has had a superlative 2019 and was up 40% this week alone.

One major exchange after another has added staking services for this coin, boosting its value like none other. So …

When we pull Tezos out of the Weiss Mid-Cap Index, sure enough, we find the balance of its component coins traded in line with the rest of the markets, down roughly 5%.

The good news is that, despite recent ups and downs, most crypto assets are still holding above key support levels. Whether they can continue to hold remains to be seen. But for now, the most reasonable expectation is more sideways action.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.