Bitcoin and most sectors of the crypto markets surged by double digits this week, and some folks are saying it was all tied to the U.S.-Iran crisis.

Yes, the Iran crisis played a major role: Investors feared an explosive regional war. They rushed to safe-haven assets, including U.S. Treasuries, gold and Bitcoin. And prices surged.

But that’s not the entire story. Here’s the full picture …

First, as we’ve been saying for weeks, despite some near-term weakness in the crypto market, the Big-Picture trend has been very positive — a new crypto bull market that’s now starting its second year.

Second, even after Donald Trump and the ayatollahs backed off from war, greatly easing tensions, most of our crypto price indexes held onto their gains.

Third, the rally was not limited to Bitcoin. Nearly all cryptos — except for the small caps — jumped higher.

Here’s the evidence …

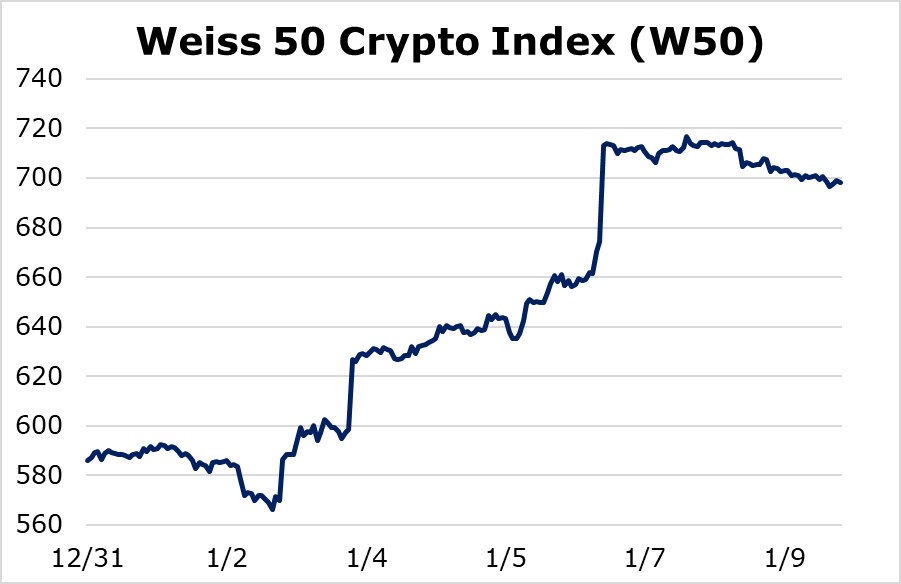

The Weiss 50 Crypto Index (W50), which includes Bitcoin and 49 other coins, was up a hefty was up 19.13% for the week ending Thursday.

|

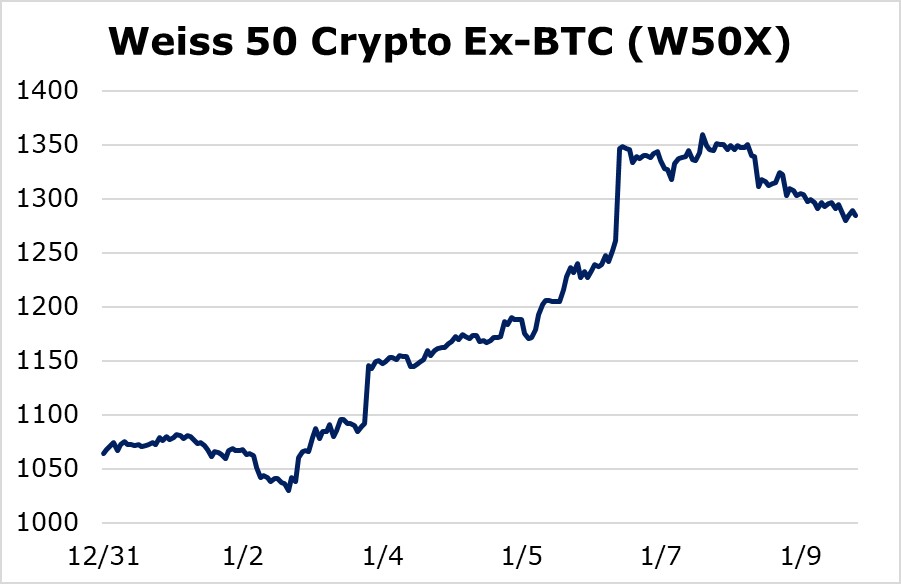

The Weiss 50 Ex-BTC Crypto Index (W50X), which excludes Bitcoin, finished the week with an even greater gain — 20.70%.

|

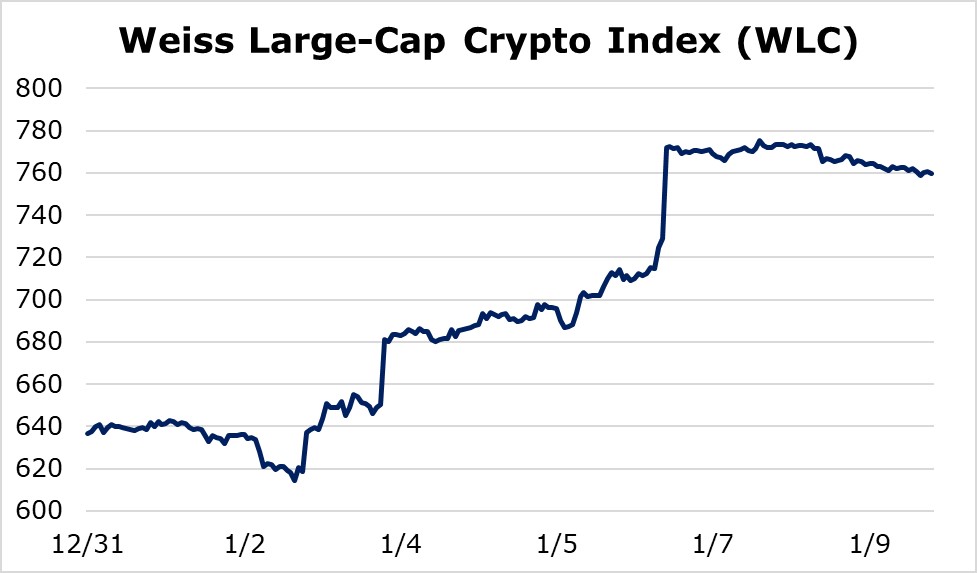

Ditto for the Weiss Large-Cap Crypto Index (WLC), up 19.34% for the week!

|

And virtually the same for the Weiss Mid-Cap Crypto Index (WMC), up 20.38%

See how all of these are moving almost in lockstep? That’s the sign of a broad, potentially powerful bull cycle — not just a flash-in-the-pan scare into safe-haven assets.

|

As I said, however, there was one notable exception: The Weiss Small-Cap Crypto Index (WSC). Toward the end of the week, it took a pretty big dip, giving back most of its gains and winding up in essentially flat, up only 1.68%

|

So, yes, the U.S.-Iran crisis played an important role. But there are two important takeaways:

First, it demonstrated that Bitcoin does very well in a risk-off environment, that it’s truly becoming a safe-haven asset.

Second, Bitcoin is not the only beneficiary. Nearly every other sector of the crypto market also surged in synch.

Third, this week proved that Bitcoin is evolving as an asset class and is increasingly recognized as an important, safe money play.

Best,

Juan

Weiss Ratings is the only financial rating agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.