Weiss Crypto Price Indexes This Week: Crypto Markets Post Moderate Gains, Large Altcoins Take the Lead

|

For most of 2019, Bitcoin has led the crypto market. This week, however, major altcoins have taken the lead as they experience the best price action — relatively speaking — in the entire crypto universe.

To better track these kinds of trends, we use the Weiss Crypto Indexes — the only price barometers that segment the industry by sector, market cap and other factors.

|

And the facts they reveal provide reliable evidence of the outperformance by altcoins this week:

Fact #1. Leading altcoins rose twice as fast.

The Weiss 50 Crypto Index (W50), which includes Bitcoin and 49 other cryptocurrencies, rose 1.87%.

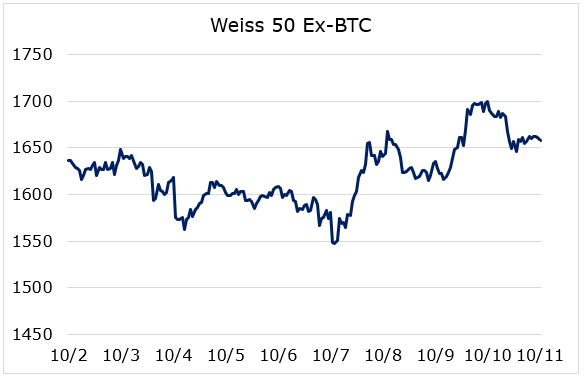

At the same time, our Weiss 50 Crypto Ex-BTC (W50X), which excludes Bitcoin and is dominated by large-cap altcoins, was up by 3.46%. That’s nearly twice as much.

Even though Bitcoin saw some gains this week, it was dwarfed by the price action of major altcoins such as Ethereum or Binance Coin.

|

Fact #2. Large-cap coins also lagged due to Bitcoin’s sideways action.

The Weiss Large-Cap Crypto Index (WLC), including 10 coins with the largest market cap and dominated 60%-plus by Bitcoin, rose only 1.65%. Bitcoin’s relative underperformance was a drag on this index.

|

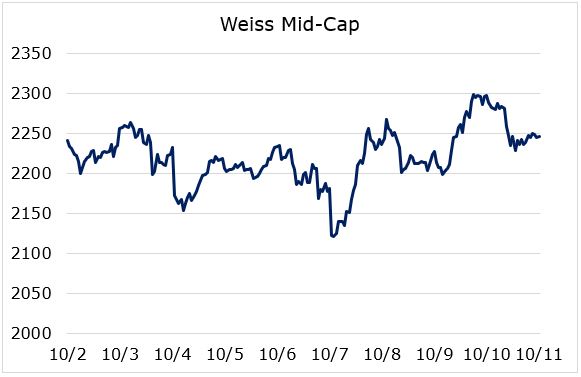

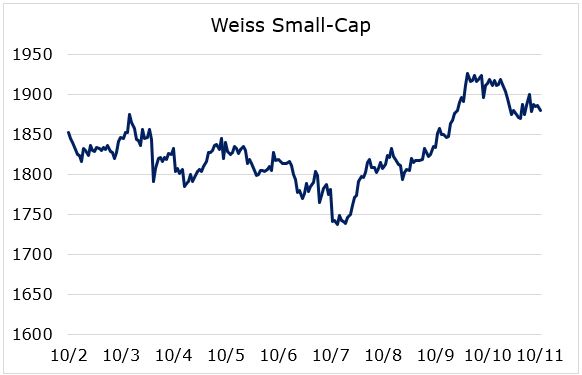

Fact #3. Midcaps and small caps lag behind major altcoins.

The Weiss Mid-Cap Crypto Index (WMC) and the Weiss Small-Cap Crypto Index (WSC) both are up 1.82% and 2.32%, respectively, this week.

|

While they both outperformed the large-cap index, it’s important to note that they’re up less than the Weiss 50 ex-BTC.

This suggests that it’s the industry-leading projects that are attracting most of the buying activity.

|

First Stage of Crypto Bull Market:

Industry Focuses on Large-cap Projects

In 2019 as a whole, we’re seeing the same pattern of consolidation: Year-to-date, the Weiss Crypto Price Indexes tell us that the dominant trend is a broad, industry-wide consolidation.

The strongest price action is among the large cap, high-quality projects:

- The Weiss Large-Cap Index is up 69.67% on the year,

- The Weiss Mid-Cap Index is down 16.52%, and ...

- The Weiss Small-Cap Index is down 42.98%.

With a few notable exceptions, only larger, higher-quality projects are enjoying strong interest, while smaller projects continue to be ignored.

Unless this trend is reversed, many could fade into obscurity.

Best,

Juan

Weiss Ratings is the only financial ratings agency that covers cryptocurrencies. Click here for more in-depth information about Weiss Crypto Ratings, including the Weiss Crypto Price Indexes and crypto-asset reviews.